Samwise Quick Reference Handbook

To streamline our daily blogs and conserve space, we’ve organized key resources into a convenient, collapsible dropdown menu below. A sort of Quick Reference Handbook if you will — as our friends in aviation might call it. By clicking the menu below, you’ll have quick access to shortcuts for all of our Samwise Model Portfolios, the Current Market Outlook, Administrative Announcements, and our Notification Center. Simply click to enlarge the content for quick, easy access.

Samwise QRH: Portfolios, Outlook, Admin Updates & Notifications

Samwise Model Portfolios

The portfolios below are separated by launch dates. Each portfolio is entirely independent and has no bearing on any other model portfolio. We launch entirely new portfolios during each market correction as an illustrative tool for new subscribers who weren’t present during the previous buying opportunities in the market. To date, we’ve launched four portfolios during two separate corrections.

Please login to view the Samwise Portfolio.

Please login to view The Current Outlook.

Notification Center

To be notified whenever we publish a new post here at Sam Weiss, you can opt to receive an e-mail alert. To be notified anytime we make a trade, you can follow us on twitter, get text alerts, email notifications or receive push alerts through our Sam Weiss Mobile App.

Today’s Trades

None.

10:00 AM EST

NASDAQ-100 (QQQ) Has Likely Topped Now

As we mentioned yesterday, a big consequence of the QQQ losing the $610 level and selling off down to $600 a share is that it would require a large segment just to get back to the highs. Nevermind making new highs, just to get back to the highs would require a large segment. This is likely to lead to one of two outcomes. We either end up with a QQQ that has formed a double-top on teh next segment or a QQQ that has formed a three push pattern. Both are bearish. Both lead to an inevitable correction.

Also, as we explained when the QQQ broke out above $613, the most likely outcome was a run to $630-$640 — as we’ve seen in every other past century breakout — a top at around that $630-$640 zone and a large pull-back to $600. From there, it’s often either THE correction has already started or the QQQ forms a double-top. This was all telegraphed way before the QQQ even broke out. It’s why our target for adding to the $500 puts was at $632-$633 a share. We set that target well before the QQQ even broke out.

The reason I mention this is to stress that this was the foreseeable and logical outcome on a breakout above $613. That’s the entire point. The market had a clear-cut default projected path and it has followed it to the letter on the breakout from$613 up to $637 and down to $600. For those who have been reading the briefings closly, you know this already.

There were all types of alternate ways the QQQ could have played out. It could have bottomed at oversold at $620. It could have held support after gap-fill at $610. Totally logical places. But the default path. The most likely path was always rally to $637 and pull-back to $600-$605. That was the main default path seen in prior century mark breakouts.

Now that we’ve seen the breakout happen the QQQ reach $603, here’s where we stand strategically. First, the QQQ is simply not oversold enough for us to trade out of our puts temporarily and buy calls. We were barely at a 25-RSI at today’s lows. What we want to see ideally is a 20-RSI. WE get a 20-RSI, then it makes sense to close half of our puts and buy September $700 calls. Right now the QQQ is in the middle of an intraday rebound. What we want to see later today is a push down to the $600 level. That would be ideal. At $600 a share, the pull-back extends to 5.81% which is a serious pull-back. There we might want reduce our September puts. Here’s where the QQQ is in terms of oversold levels:

This is the third push down into oversold, but we’re not quite deeply oversold. We need to be careful not to exit right in the middle of what could be a correction. That’s why we really need deeply oversold conditions as that lowers the risk of us getting out in the middle of a correction.

Also, as we mentioned, even in MOST corrections, deeply oversold leads to a rebound.

So just keep in mind we *MIGHT* close out half of our September $500 puts at around the $600 level on the QQQ. Notice how they’re trading at $17.55 with the QQQ at $604. Last time the QQQ was at $604, they were trading closer to $15.85. Ever since the QQQ broke out above $613, it’s like the options market called bullshit on the entire move. We should have been able to buy at like $11-12. The lowest they ever got was $13 at $633 and then they didn’t drop at all from $633 up to $637. The just sat there $13. And when the QQQ peeled back to $633, it went up in value.

Anyway, the point is we might look to sell at $600 as long as the QQQ is deeply oversold at that point. If it’s not deeply oversold, then what we might do given that $600 is key support is simply just close out 10 contracts or 25% of our position at $600. That makes the most sense if it’s not deeply oversold at that point. Especially as we’re heading into a weekend.

We definitely CANNOT buy calls unless we’re deeply oversold. We’re absolutely not going to do that.

10:00 AM EST

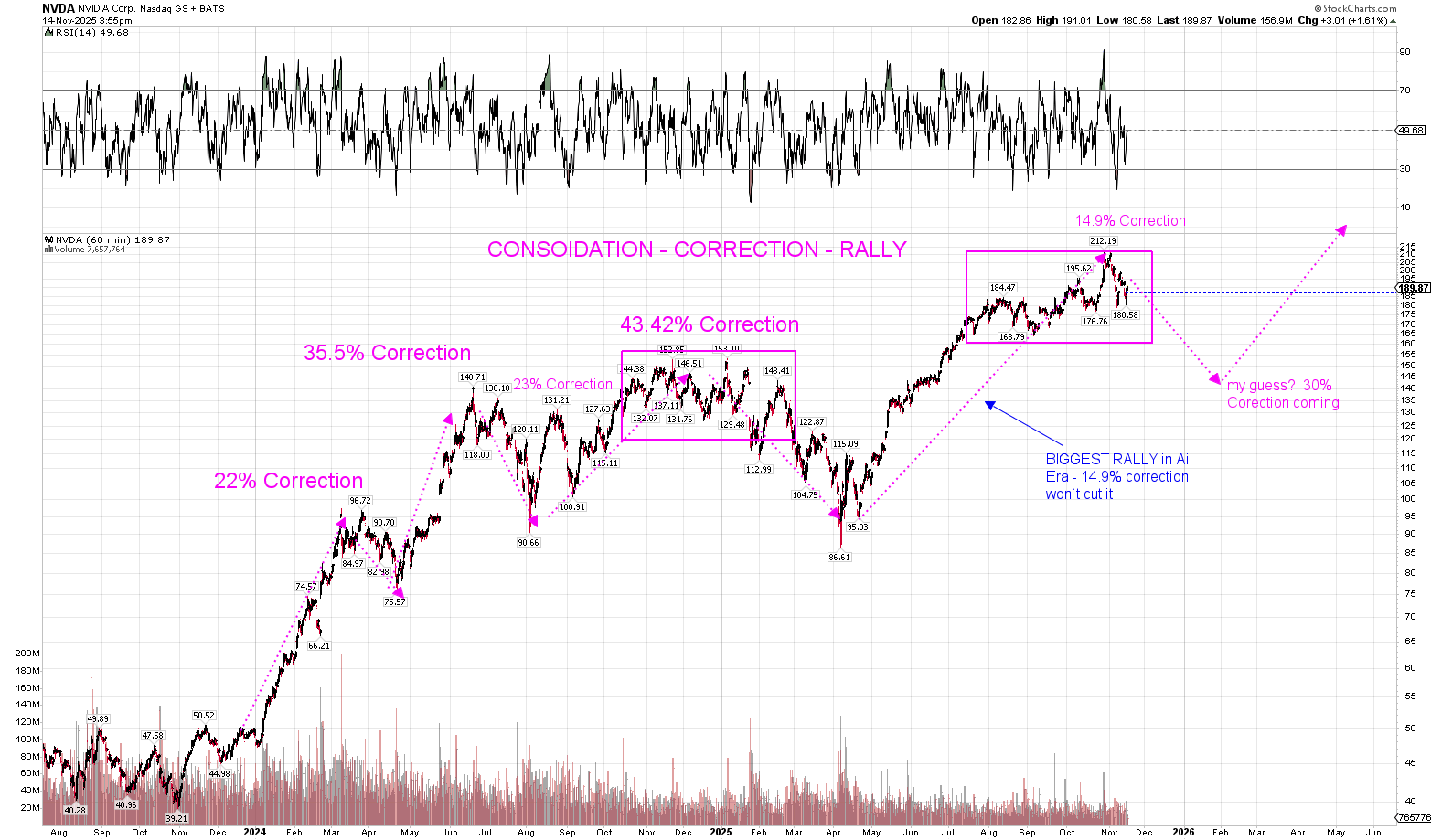

Nvidia Deeply Oversold — Might Close out November $170 Calls in Common Stock Portfolios

Nvidia has reached deeply oversold territory today and it might be time for us to close out our NVDA November $170 covered calls we sold against our long Nvidai common stock positions in Tarly, Tyrell and Frey. In all three portfolios, we’re holding Nvidia common stocks – 200 shares in Tarly and Tyrell and 100 shares in Frey – hedged by a mix of puts and covered calls. Now we sold the November $170’s at $20.00 a contract. So if the QQQ close south of $190 at November expiration, we make money on those. With Nvidia down to $183 and now deeply oversold, there may be an opportunity for us to close those out and resell them on the bounce. So we might do that today if the QQQ ends up pushing down to $600 and Nvidia ends up paring back to $180. That’s an opportunity. See chart below:

The key thing we need to remember, however, when it comes to Nvidia oversold conditions is that in bearish environments like the April correction, it has been known to stay deeply oversold for a while before ultimately rebounding. Meaning, we could see more downside or Nvidia simply dilly dally along for several days before actually rebounding. Hence why we’d like to wait until it reaches $180. We may do nothing as the options were sold at $20.00 a contract putting us at break-even at $190. Nvidia can close out November 21 at $190 and we’d ve even on those. It would allow us to roll forward to December. Eventually we’re going to collect a massive premium once the correction hits. Considering we bought the shares at $100, a $20 sale is an enormous reduction in basis.

10:31 AM EST

TRADE WATCH: QQQ September $500 Puts, QQQ September $700 Calls & Nvidia $170 November Covered Calls

Here’s the current trade watch.

(1) First, depending on whether we get a test of the $600 level today and whether we reach deeply oversold when that happens, it will impact position sizing.

If the QQQ is DEEPLY oversold (20-RSI) once it reaches $600, THEN…

We sell HALF of our QQQ September $500 puts in Arryn, Stark and Lannister

AND

Buy an equal number of QQQ September $700 callsin Arryn, Stark and Lannister. Doing so would put us at a 1:1 ratio of puts to calls. We’d own 20 Contracts of the September $500 puts in Arryn for example – having sold 20 – and we would own or buy 20 contracts of the Sepember $700 calls. The goal would be to close out the September calls on the bounce an re-purchase our puts.

(2) Second, if the QQQ is NOT deeply oversold when/if the QQQ reaches $600 a share, then we are only selling 1/4th of our September puts. We’d shave our position slightly. That’s it. IN Arryn, we’d close 10 of our 40 contracts for example and then wait.

If the QQQ breaks down under $600, reaches deeply oversold at that point, then we sell the other quarter position and get long. We’d follow plan #1 above in that case.

(3) Buy to Close/Cover our Nvidia November 21, 2025 $170 calls we sold at $20.00. The goal is to cover those at a price level far below where we sold them short. We’d then wait for a bounce and re-sell them giving us extra premium ahead of November 21 expiration.

10:31 AM EST

Segmented Pull-back Extends to 5.36%; Largest Pull-Back Since The Bottom in April

Take a close look at the segmented rally table below. This is now the largest pull-back of the entire rally at 5.36%. At $600 a share, that extends to 5.81%. And notice if the QQQ closes near $600 today and gaps down on Monday, then we’re already nearing correction level selling. At $595, the Segment extends to 6.6%. The 8% mark sits at $586.04 a share. That’s where we’d have to initiate long positions for the next rally. This is why we hedge ahead of time. After this entire rally, we’d have to start getting long at $586. A hedge allows us to do that without feeling as if we’re buying right in the middle of a correction.

Table 3.0: NASDAQ-100 (QQQ) Segmented Rally Cycle

Table 3.0 analyzes the Segmented Rally Cycle. Market rallies don’t simply climb steadily upward from one correction low to the next market peak. Instead, rallies typically unfold in a stair-step pattern, which we refer to as “Segments.” Each segment typically involves the market rising sharply by around 8–10% over a period of 10–15 trading sessions, followed by a pullback of about 3–5% lasting 3–7 sessions. A full intermediate-term rally usually consists of 3–5 of these segments, spanning roughly 40–70 sessions between corrections. Table 3.0 details the size, scope, and duration of every Segmented Rally within the 2023–2025 bull market.| Segmented Rally Date | Rally Days | Rally Pts. | Rally % | Peak Price | Low Price | Pt. Loss | % Loss | Trading Days to Bottom |

|---|---|---|---|---|---|---|---|---|

| Nov 2025 | 13 | $48.47 | 8.35% | $629.21 | $606.97 | -$22.24 | -3.53% | 5 |

| Oct 2025 | 13 | $47.96 | 8.14% | $637.01 | $602.85 | -$34.16 | -5.36% | 7 |

| Oct 2025 | 12 | $24.68 | 4.19% | $613.18 | $589.05 | -$24.13 | -3.94% | 1 |

| Sep 2025 | 15 | $43.98 | 7.87% | $602.87 | $588.50 | -$14.37 | -2.38% | 4 |

| August 2025 | 9 | $31.60 | 5.73% | $582.64 | $558.19 | -$24.45 | -4.20% | 6 |

| July 2025 | 28 | $50.98 | 9.74% | $574.63 | $551.68 | -$22.95 | -3.99% | 2 |

| May 2025 | 13 | $31.17 | 6.17% | $536.18 | $523.65 | -$12.53 | -2.34% | 8 |

| Apr 2025 | 11 | $46.16 | 9.69% | $522.41 | $505.01 | -$17.40 | -3.33% | 3 |

| Apr 2025 | 10 | $62.98 | 14.72% | $490.91 | $476.78 | -$14.13 | -2.88% | 4 |

| Feb 2025 | 12 | $29.72 | 5.82% | $540.01 | $508.68 | -$31.33 | -5.80% | 5 |

| Jan 2025 | 8 | $34.07 | 6.83% | $533.03 | $509.39 | -$23.64 | -4.44% | 3 |

| Dec 2024 | 21 | $44.67 | 8.29% | $539.16 | $509.00 | -$30.16 | -5.60% | 3 |

| Nov 2024 | 8 | $31.88 | 6.60% | $515.58 | $494.49 | -$21.09 | -4.10% | 5 |

| Oct 2024 | 9 | $21.48 | 4.50% | $498.88 | $485.05 | -$13.78 | -2.76% | 7 |

| Sep 2024 | 15 | $46.20 | 10.32% | $493.70 | $477.40 | -$16.30 | -3.30% | 4 |

| Aug 2024 | 14 | $62.09 | 14.66% | $485.54 | $467.89 | -$17.65 | -3.64% | 5 |

| July 2024 | 12 | $29.70 | 6.27% | $503.52 | $473.94 | -$29.58 | -5.88% | 7 |

| June 2024 | 12 | $43.74 | 9.89% | $486.09 | $473.82 | -$12.27 | -2.53% | 6 |

| May 2024 | 16 | $39.89 | 9.50% | $459.85 | $442.35 | -$17.50 | -3.81% | 6 |

| Apr 2024 | 7 | $20.66 | 5.01% | $433.07 | $419.96 | -$13.11 | -3.03% | 4 |

| Feb 2024 | 9 | $22.28 | 5.36% | $437.86 | $420.40 | -$17.46 | -3.99% | 7 |

| Jan 2024 | 13 | $34.41 | 8.73% | $428.60 | $415.58 | -$13.02 | -3.04% | 6 |

| Dec 2023 | 18 | $31.13 | 8.18% | $411.72 | $394.19 | -$17.53 | -4.26% | 6 |

| Oct 2023 | 24 | $51.51 | 15.13% | $392.01 | $380.59 | -$11.42 | -2.91% | 4 |

| Sep 2023 | 13 | $22.26 | 6.37% | $371.72 | $357.00 | -$14.72 | -3.96% | 5 |

| Aug 2023 | 11 | $25.94 | 7.36% | $378.22 | $365.12 | -$13.10 | -3.46% | 4 |

| July 2023 | 17 | $30.18 | 8.50% | $385.32 | $371.77 | -$13.55 | -3.52% | 4 |

| June 2023 | 8 | $24.22 | 7.01% | $369.78 | $355.14 | -$14.64 | -3.96% | 6 |

| May 2023 | 8 | $27.71 | 8.48% | $354.56 | $345.56 | -$9.00 | -2.54% | 4 |

| April 2023 | 20 | $28.55 | 9.29% | $335.89 | $326.85 | -$9.04 | -2.69% | 5 |

| Mar 2023 | 8 | $30.25 | 10.71% | $312.66 | $302.27 | -$10.39 | -3.32% | 5 |

| Feb 2023 | 7 | $32.18 | 11.56% | $310.62 | $294.35 | -$16.27 | -5.24% | 7 |

| Jan 2023 | 8 | $24.11 | 9.35% | $281.91 | $271.22 | -$10.69 | -3.79% | 2 |

| Jan 2023 | 3 | $16.16 | 6.00% | $287.38 | $278.44 | -$8.94 | -3.11% | 3 |

| Averages | 12 | $33.84 | 8.67% | – | – | -$16.17 | -3.75% | 5 |

One thing also worth nothing about this segment pull-back is the number of trading days. We’re now at 7-days for the pull-back. That’s actually on the longer side of the spectrum. Segmented rally pull-back simply don’t last much longer than this. In fact, we should be rallying on Monday morning. If this is just a segment pull-back, we should see the market gap-up on Monday and then begin a rally back to $637.

Trade Executed: Sell to Close QQQ September 2026 $500 Puts @ $18.30 x 20 Contracts

15% Portfolio Reduction

$36,400.00 Cash Received

None.

Trade Executed: Sell to Close QQQ September 2026 $500 Puts @ $18.30 x 10 Contracts

14.75% Portfolio Reduction

$18,200.00 Cash Received

None.

Trade Executed: Sell to Close QQQ September 2026 $500 Puts @ $18.30 x 18 Contracts

18.3% Portfolio Reduction

$32,760.00 Cash Received

None.

11:15 AM EST

Took Middle Ground: Sold Half; Waiting on Getting Long Calls

We decided to ultimately sell half of our September puts at $18.30. That’s a fairly big gain in 7-days where they were once trading under $13.00. So here’s what we decided to do. Instead of selling a quarter, we decided to just sell half and wait on the call side of the trade. If the QQQ becomes more oversold and hangs around these levels throughout the day and as we head unto the end of the day, we will buy 1/2 of our call position. What I don’t like. What I absolutely hate about getting long is that it’s Friday.

I can easily see the QQQ close at $598 today only to then gap-down to $589 on Monday. That would suck. So I think we just need to be careful about the long swing trade. I think it’s a good trade because the QQQ very consistently rebounds off of oversold conditions and that’s exactly what should happen right here. But I don’t like that it’s Friday and that we could be potentially heading into a very bearish Monday. If this were any other day of the week, we’d be getting long at $600.

SO let’s observe for bit. Wait for the hourly RSI to stretch into deeper oversold conditions. From there, we’ll buy a quarter long position putting us at 2:1 put-to-call ratio for September. By the way, here’s where we’re at on the hourly now:

Ideally, we want the QQQ RSI down to 20 and for an extended period. We want a thick red oversold area. Kinda of like what we see between August 18 and August 25 on the chart above. Note where it says “watch oversold” in blue annotation on the chart. That’s the ideal oversold set-up. Thick bar down to 20 or under. That gives us plenty of evidence that a rebound is coming. And the QQQ should rebound up to around $612-$615 a share. Enough where we could end up collecting 2-3 points. Those 2-3 points act as a full reduction of our basis when we buy back the puts at a reduced price. That’s how we can really knock this out of the park in a correction. We just need to get it right by waiting for the optimal set-up here.

12:00 AM EST

NASDAQ-100 (QQQ) Getting a Nice Thick Oversold Bar Now

We’re getting exactly what we want now. With the QQQ having fallen under $600 a share, we have a clear-cut thick oversold bar on the hourly now. The probability that we’ve entered a correction has now also skyrocketed. That doesn’t really change the calculous much as we still should expect large rebounds in corrections. So here’s what we’re going to want to do now. We want to consider buying the calls. But it’s still early in the day. I’m hoping the QQQ will get messy and we can end up down near $596 or something. That would be great. That’s actually far far less threatening than if the QQQ closes at $600 or above. A close at $600 just begs the market to gap-down 10 on Monday. But if we close under $600 — at like $596 — it’s less like to go through that rug-pull as we’ll have already broken support. There’s no Sergeant Doakes yelling, “Super MFer,” when the market opens.

Instead, if we close down deeply oversold, we’re more likely to either gap down small on Monday followed by a sharp rebound or we’re straight up likely to see a gap-up on Monday.

One thing is very clear though. If the QQQ closes well under $600 today, it’s a pretty big statement from the market that we’re in a full blown correction. There’s no reason for the market to do so other than its in a correction. That’s because as a the segment goes, the QQQ has done everything required to set-up a new rally. In fact, that was completed at $610 with $605 being the extreme oversold. But falling under $600, it’s pretty much an indication that we’re in a correction.

As for how long to play the bounce, it’s to the mid-line. The QQQ should bounce to the mid-line.

Strategically, just so everyone is aware ahead of time, we’re not closing the September calls unless we’re profitable. Straight up. Since corrections are on the shorter side and since we already own an equal number of put contracts and most importantly, since the calls are cheap, the allocation is small. We’re not going to buy them at $596 or something and then close them at $582. That’s not going to happen. Instead, if the QQQ continues selling off ignoring oversold conditions, we’d hold them together with our puts until the QQQ did rally at which case we’d only close if we were green or close to even. As they expire in 10-months, there’s zero incentive for us to close at a loss at any point in time. That’s how we’re doing it here.

The way we see it, if we got long at $596-$597 with a 20 contract position ($40k position), we would either close them on the bounce or after the correction during the net rally. We’d incorporate it as part of our core long position.

For example, suppose we entered a “full-blown” bear market where the QQQ fell 40%. That would be a drop from $637 down to $380 a share. Our September $500 puts would rise to roughly $130 per contract × 20 contracts = $260,000. We could quite literally burn the remaining $143K of capital on the sidelines and it would have zero impact. Our portfolio would still be north of $260K, which would mark an all-time high.

What if the QQQ only falls to $440-450 a share? Not quite a bear market, but big sell-off. In that case, the puts would rise to around $75, and our capital on the sidelines would be invested in 2027 LEAPs that would both retain value and skyrocket in the next rally. The puts at $75 × 20 contracts = $150,000. We currently have $183,000 in cash on the sidelines, by the way. $40K of that would be in the September 2026 $700 calls. We can assume those go to $0.00 (they won’t, but we can assume it). The remaining $140K would be invested in long-term LEAPs that might lose 50% of their value (again, they likely won’t, but let’s assume it).

Even on a drop to $450, we’d be at $150K + $70K = around $220K in a worst-case scenario.

What if the QQQ only drops to the low $500s? Then it’s just a big correction—there’s no reason to think we’re in a bear market, and the QQQ would likely rally to $700 or at least back to its all-time highs in the next move up, probably by April. Our September $700s would rise to around $25–$30 per contract.

The point is if we got long at $596-$597 there really aren’t a lot of circumstance leading to any sort of loss. We’re hedged and we’d likely make money on the overall trade

I mention this because I don’t want to field 100 questions about exit strategy. Our exit strategy—if we go long 20 contracts (Arryn) in the September $700s—is simply to hold that position until it’s profitable. These contracts are most likely to see a profit at some point between the time we buy them and the time we exit. We’re not going to buy them, watch the QQQ drop 10 points, and then close them. We’re not doing that. We’re not playing that game.

As the QQQ has rebounded to $602, it could be a moot point, we’ll see. We still have 3.5 hours of trade remaining.

12:47 PM EST

ARRYN back to $240k — this is why allocation Size matters

The Arryn Portfolio is back above $240,000—right where it was before we ever put on the spread trade. In fact, Arryn was sitting at $240K in July, before a single put-spread position was opened.

This is precisely why allocation matters. We’ve had to deal with a lot of unnecessary noise—emails, comments, and anxiety—that could have been completely avoided by following strict allocation discipline.

Would Arryn be higher right now if we hadn’t made the spread trade? Sure. It might be sitting closer to $260K. The September puts produced roughly $14,000 in profit, while the spreads resulted in about a $29,000 loss—a net $15K hit on a $255K portfolio. That’s a 5.88% drawdown, which is insignificant in the context of a LEAPS portfolio.

A 5–7% daily fluctuation is standard when fully invested in LEAPS. So a 5.88% drawdown after a 155% gain over the past 12 months is nothing. The frustration and emotion some have expressed come down entirely to poor allocation. When positioned properly, a small setback like this shouldn’t cause anyone to lose perspective.

And keep in mind, Arryn’s position size was small, but the potential payoff was huge if it worked. For example, with just 6% allocated, if the September 30, 2025 puts failed but the October 17, 2025 spreads succeeded and the QQQ closed fully in the money, we would’ve made about $60,000 in profit while taking only a $7,000 hit on the September trade. That’s a $53,000 net gain. Add back the $29K loss, and you’re talking about an $82K swing—the portfolio would be sitting near $325,000, up 225% overall.

We didn’t need a massive allocation to have that kind of upside. And when the next rally comes—and it will—we’ll put on the same type of trade again and capitalize. Future rallies will likely end in the 80–100 day range, and when they do, we’ll be ready.

12:53 PM EST

TRADE WATCH UPDATE: QQQ $700 Calls; Nvidia Nov $170 Calls

First, we’re no longer planning to cover the Nvidia $170 calls. They’re simply too expensive right now. They’ve only dropped 5 points to $15, and at that level, it makes more sense to just hold them.

If Nvidia closes above $190 by November 21 (10 days from now), we’ll cover the position and sell future calls—rolling the position forward. The reality is that the market is going to sustain a correction, and eventually one of these covered calls will expire worthless.

If they drop to $10, we’ll cover them—because at that point we’d be locking in a 10-point profit. But at $15, we run the risk of leaving 15 points on the table and being unhedged at $180. That’s not a risk I like. So for now, we’re holding the Nvidia covered calls that were sold against our common stock positions.

Second, we’re watching the September $700 calls, currently trading around $19.00–$19.50.

- Arryn: 20 contracts @ $19.00–$19.50 (16.7% portfolio allocation)

- Stark: 10 contracts @ $19.00–$19.50 (15.2% portfolio allocation)

- Lannister: 19 contracts @ $19.00–$19.50 (19.2% portfolio allocation)

Those are the trades we might be putting on soon.

4:12 PM EST

QQQ Rebounds Strongly off of Oversold Largely As Expected

The QQQ has rebounded off of the $600 level largely as expected. Now you see the effect plain as day hopefully. The QQQ reached deeply oversold near a 20-22 RSI at today’s lows and proceeded to rebound aggressively back up to $610. We could have easily gone long on it. We probably should have pulled the trigger and bought the Sep $700 calls under $20.

But at least we closed half our put position and we’ll shave cost-basis off of our entry as a result.

Here’s our plan for the September puts. First, we will probably look to buy back the position we sold at the mid-line around $615-$617 a share. If the QQQ continues higher in a new segment we will buy a 10 contract position in the Sep $550 at around $625 a share and add another 10 contracts at $630. We will add a final 10 in the high $630’s. That’s how we’ll approach things.

With the QQQ having fallen 5.8-5-9%, the odds of a correction have skyrocketed and so we need to be thinking in terms of being more aggressive with the put purchases than we were prior to the segment pull-back. Originally, we want to be 40 contracts long the $500’s and 20 contracts long the $550’s. W e’ve increased that to 40-30. We’re targeting 40 contracts long the Sep $500’s and 30 contracts long the $550’s. Then on the way back down we’ll reduce down our $550’s and look to hold 20 total contracts in the Sep $550’s by the bottom of the correction. That’s our general plan for Arryn with Stark/Lannister following the same allocations but on a smaller absolute scale Fewer contracts but the same overall ratios and allocation sizes. Here’s where the QQQ ended the day. Well off of oversold conditions:

Hi Sam, how do you qualify if qqq is deeply oversold on the daily?It’s a good question worth answering. So I count “oversold” as anything near or under a 32-28 RSI. A 30-RSI is technically oversold. but you can also have a stock oversold at a 32-33 RSI. Just coming within that range is oversold. It’s’ better to think of it as a “zone” instead of a hard line.

That’s becuase you can easily see a stock reach a 32-RSI, bottom and then go on to have the SAME EXACT effective rebound that it would have had it reached 30. So there’s often no fundamental difference between a stock reaching a 28-RSI, 30-RSI or 32-RSi. Same end result. We get down close to 32, we start thinking “it’s oversold.” That’s true on the daily chart or hourly chart. It’s the same exact process.

The difference of course is impact. Oversold not eh daily has a MASSIVE impact. It often means a 10% minimum rally is due. Oversold on the hourly often means a rebound of 2-5% is due.

—–

Deeply oversold is the same general concept. Think of it as a zone instead of a hard line. But the line sits at 20-RSI. A 20-RSI = deeply oversold. However, the QQQ gets down to as low as a 22-RSi, that’s also deeply oversold.

Now one added wrinkle to deeply oversold that we don’t see at oversold.

When we say deeply oversold there’s both size and duration here.

A stock comes down to a 20-RSI exactly and then immediately rebounds only having spent 1-hourly bar down there isn’t quite deep oversold in the duration sense.

Right now, for example, we’re looking for duration. We want the QQQ sitting sold for several hours because the you get that really thick oversold bar. And that’s when you can bank on a big rebound.

So deeply oversold has aspects of duration built into the definition. We want to see a stock reach a 20-RSI or even a 22-23 RSi on long duration. In fact, if hte QQQ pushes down to a 23-24 RSI and sits down there for 4-5-6 hour morning a wide oversold bar, that is 100x more predictive of a bounce than if hte QQQ went down to a 19-RSi intrahour.

So as you a see, duration plays a big part in the analysis. We want extended oversold conditions.

I see, thank you Sam.

Hi Sam,

With the pullback extending to 5.36% does that mean we’re technically already in a correction since a 5% pullback represents the end of the rally based on the data?

Thanks!

No. Not quite. If you look at the segmented pull-backs, we have 5.36%+ pull-backs all the time.

For corrections, there are very very narrow exceptions where we count a 5.36% pull-back as a correction. That’s usually in a melt-up environment where there has bene nothing even close to that level of voaltity. Liek the most you generally might see in a melt-up is 1.5-2% pull-back. And so when we get a 5-6% pull-back which shows up as a clear-cut off-trend move, we count that as a correction.

But generally speaking, a sell-off needs to extend to 7-8% minimum to count as a correction.

—

If you look at Table 4.1 and sort it for correction size, you’ll find four corrections that are sub-7% and another 6 that are 7-7.99%. So 10 corrections at 7.80% and under.

For those 10 corrections, in a full SEVEN (7) of those cases, the rally leading into the correction was under 20%. So we’re talking sub-average rallies for 7/10 of those smaller corrections.

17.74% rally to 5.95% correction

17.86% rally to 6.32% correction

16.96% rally to 7.00% correction

16.67% rally to 7.53% correction

14.66% rally to 7.70% correction

12.95% rally to 7.76% correction

15.39% rally to 7.80% correction

So those make all kinds of sense. YOU can’t generally have a 15% rally leading into a 10% correction. So a smaller correction after a smaller sub-average (22% or less) rally makes sense. That’s all you’re going to generally get after a smaller move higher.

In three cases, we had the August 2010 rally – which has always been an outlier in my book, I was there. I remember it clearly. It came right off Bernanke’s QE2 Jackson Hole speech and the market had just ended a brutal correction from May to August. It’s the correction that had the May 6th flash crash. I think coming off of a big 20% correction coupled with the QE2 announcement really drove the market higher. So we had a 26% rally and only a 5.89% correction. It’s an outlier case.

Then we had a 38.18% rally in March 2009 which I wouldn’t call an outlier at all. While the correction was small at 6.71%, we had just ended a 55% crash. I mean the S&P 500 was rallying of off a low of 666 after having previously peaked at 1540. So we’re talking a 56% crash and this was THE recovery rally off of the lows. We had mlutiple corrections on the way up, but taht first recovery was off of extraordinary circumstances. So it makes sense we’d see smaller pull-backs off of of bear market recovery.

Then we have a July 2009 — which is the second leg up in the financial crisis recovery period — there we had the QQQ rally continuing going up 27.89% and leading into a smaller 7.26% correction.

So that’s how to sort of view the data. We have 10 sub-8% corrections. 7 of them follow 7 sub-20% rallies. 2 are bear market recovery rallies. 1 is an outlier in August 2010.

We also had a smaller 8% correction after a 31% rally between November 2023 an March 2024. That was also kind of an outlier case. Though what came next was a smaller rally and a much much much larger correction relative to the rally.

The QQQ rallied from $338 a share up to $446 (mid-century) between November 2023 and March 2024. That’s a 32% rally over 100-days. The QQQ then pulled back only 8% in a premature bottom. After that bottom, the QQQ rallied from $410 a share up to $502 a share in a 22% 55-day rally. It then crashed 16% from $500 down to $423.

A 16% correction is huge for a 22% rally. Part of that correction is the result of the QQQ not having sustained a proper pull-back after the Nov 2023 to March 2024 rally.

At least that’s what it felt like to me. That whole 55-day rally felt extreme within the context of not having sustained a true full correction and the sell-off that followed felt like the QQQ was repaying a debt for having not corrected property after the Nov 2023 – March 2024 rally.

Most of the sub-10% corrections involve either rallies that fall short of 20% returns — which again makes total sense — or they involve a bear market recovery rally of some kind.

There are rare cases like the August 2010 or Nov 2023 to March 2024 cases. Those are the rare exceptions. In most cases, sub-10% corrections occur as a result of either a melt-up rally or a small percentage returning rally.

Here’s what we have for the 8-10% range:

15.78% rally to 8.36% correction

21.26% rally to 8.38% correction

9.55% rally to 8.63% correction

40.43% rally to 8.63% correction (2003 bear market recovery rally)

16.34% rally to 8.93% correction

20.77% rally to 9.08% correction

10.51% rally to 9.65% correction

14.95% rally to 9.69% correction

14.36% rally to 10.25% correction

^that’s the pattern. So as you can see, the 8-10% range corrections truly are on the rare side and mostly only occur as a result of a smaller rally to begin with.

Now you see a lot more of these outliers when counting melt-up rallies — rallies where the daily return rate is very low, volatility is very low and the rally has extended to twice the typical duration for a rally of its size. In those situations, you often get a sub-10% correction.

You ask really good questions, by the way, which results in me learning something new here. We may very well go about this correction differently from what this data indicates. We will write a post about it.

I’m now thinking 8% corrections are a lot more rare than I first realized.

In fact, the probability that we’re going to see an 8% correction here is far lower than I first thought.

Really, what the data below show is that 8% corrections normally only happen if one of two things is going on:

(1) We have a bear market recovery rally where there is a ton of optimistic buying happening. It makes sense — we just sustained a 40% crash in the market, and a lot of people are getting in ahead of the wealth-creating new bull market. Of course the corrections are going to be shallow; or

(2) The QQQ has only generated a very small sub-20% rally.

Those are the only two conditions where we most often see an 8% correction.

Now, there are outliers, of course, but they are exceedingly rare.

When looking at the data I’ve outlined, we only have two exceptions to this, right? We have an exception in the 2023 to 2024 rally, and then we have an exception in the QE2 rally.

Interestingly, in both cases, the market was coming off of a very long-duration correction.

The November 2023 to March 2024 rally occurred after the longest 71-day correction we’ve seen on record.

The QE2 rally also followed one of the longest corrections we’ve seen, spanning from May 6 all the way until the end of August.

That’s a very, very long correction lasting over 3½ months or 70+ sessions.

So, in both cases where we had a smaller correction, they occurred in the rally following a very long-duration correction.

There may have been some sort of resistance to a big correction when the market has come out of a very long correction.

But this is worth a closer examination because I’m now thinking an 8% correction may not be something that we should be banking on.

Certainly, we should be taking some sort of long position there, but I don’t think we should be betting on it.

I think the end result is that if we do see an 8% correction, it will just mean that the market will rally but then sustain a much larger correction thereafter.

I mean, the rally that we saw after the bottom in March 2024 was just a 55-day run. That’s shy of only three months, and then the QQQ went on to fall 16%. So there were consequences.

Here, because we rallied 60%, we’re far more likely to sustain a much larger correction.

I think the strategy we’re going to need is to buy call spreads — something that hedges out the risk of us getting caught on the sidelines in cash and will produce big returns if the market does something like it did in March, but which also allows us to sit on the sidelines with a substantial amount of cash so that if the correction is larger, we’re able to buy at lower prices.

I’m going to think about this very carefully over the weekend, but I’m sure there’s a strategy that we can use.

It won’t have to be anything as aggressive as the put spread strategy, but we can do something like buy three- or four-month expiring call spreads that produce the same return we would get if we’d been fully invested in long LEAPS.

The point I want to make is that the question you asked here got me thinking about things in a different way, as it led me to look at the data concerning smaller corrections a little more carefully.

I hear you, but we’ve also just come off a 25% correction. The rally was huge, but is it really that disproportionate to the drop we just had? Wouldn’t it made sense to expect a correction slightly larger than 8%, but not by much?

Yeah so probably like covid. It’s the same exact situation. 30% correction leads into an 84% rally and into a 14% correction.

It should be larger than 10%.

Makes sense, thanks!

With this new insight in mind on the rarity of 8% corrections, it’s possible that today’s selloff might have been the “correction” or could count as one depending on how things play out. Is that right, Sam?

When we say “rare” we mean “ONLY 8% is rare.” Meaning, it would be rare for the QQQ to ONLY drop by 8%. We’re expecting the QQQ to fall to at least $570 or lower.

Today’s rebound is in-line with our oversold bounce expectations. We should have probably bought the moment the QQQ fell under $600 to be honest. WE should have just pulled it because we were right near a 20-RSI. Kind of rationalized waiting today.

Next step is to buy back the puts we sold thereby reducing our basis. Already, they’re off nearly $1.50 from where we sold them. That’ sa pretty big reduction.

Did you sell half or a quarter of the puts?

Half. we sold half our position in each portfolio.

Hi Sam,

Thanks for the update today.

I have been looking at META and initially thought about getting into META leaps when it hits 600. However, since the correction has not started yet, do you think its better to wait or would be ok to start an initial position at 600 ?

So we wouldn’t get long, basically anything until the correction has ended. That’s just me. We would rather wait until the correction ends because the correction impacts all stocks.

If the QQQ ends up having a 16% correction, META is going to be substantially lower along with everything else.

All stocks go down together

Great updates Sam. Any likelyhood we sell the June puts or are we looking at holding them longer? Not a big consideration either way.

We are going to hold the June puts until the bottom of the correction. We want exit those at peak, favorable volatility.

So for example, if the QQQ reaches a 30 RSI on the daily has been selling off very heavily is down 12-13-14%. That’s where we wanna close them out.

I am personally still holding a pretty big position in the June puts. So I’m watching them very closely.

I am holding most of the same positions you see in Arryn. I’ve mostly traded the same way.

We want to exit this correction having closed out the June and March put to be honest.

We should be holding the Septembers when this correction ends

If for some reason we have closed the September puts it means that we are going to be in a huge positive position

Because the only circumstance under which we’re gonna close out, the new hedge is if the QQQ does what it didn’t April and goes down to a 20 RSI

In that case, we would close out the puts and end up 100% long for the inevitable 10% bounce at which case we would buy a new hedge

Exactly as we did back in April.

There are different levels of extremes that call for different measures

so we go back up to 617ish and drop to 580 or lower??

Yeah, we could easily get as high as 617.

Think of the legs like this 40 point leg from 637 down to 597

20 point rebound from 597 to 617

40 point drop from 617 down to 577

This would be a two legged correction.

Back in April, we had two 80-point legs down.

540 down to 460. Rebound to 480 with a sell off down to 400.

——

Same general concept here smaller correction

does it take 2-3 weeks for 40 point drop?

yeah it could. I mean look at today. We’re on day 7. It took 7-days for the QQQ to go from $637 down to $598. So 1.5-2 weeks.

Sorry to resorting to ask, but I could not find where are the tables.

They’re under the link called NASDAQ Tables. See here:

https://sam-weiss.com/nasdaq-100-qqq-corrections-rallies/

Hi Sam, Any plan for Baratheon and Targaryen

Not at the moment. We may put on trades there down the line.

Sam, We have bounced pretty nicely from the $598 low today. Does that change anything? Does that make it more likely that we will rally for a few days, before we get the next drop?

So oversold bounce has already started. We should peak in a few days just north of the mid-line. If we’re on a new segmented rally, then I’ll go further toward overbought.

There are a number of ways this can play out.

Anything can happen in the last hour and twenty minutes, but what do you think happens if QQQ closes green? Does it continue to bounce back before hitting the midline? Or is it in the same situation as closing at $600 where it could gap down?

No. A reversal like that is positive. the market probably rebounds on Monday toward the mid-line.

Looks like the window/conditions to confidently go long is gone for now. If a rebound to the mid-line takes us to $610+, is the thinking to still buy puts ahead of the next leg down?

Saw Sept. ’26 $700 below $19.50 at one point and ended $3.00 higher. Just goes to show how potent that oversold setup is but I get all this taking place on a Friday muddies it