As we head into Thanksgiving, I thought we should outline where things stand with the market and how we plan to proceed in light of the sell-off that transpired over the past three weeks. We’ve also be updated our November 2025 Investment Strategy for SW Model Portfolios post we started last week and we’ve outlined our general plan of attack within those portfolios. This post is just a status update and review. First, we’ll discuss our outlook for the market and the different ways things can play out from here. Then we’ll talk about how our generally investment strategy takes all of those different things into account in the article linked above.

Investing is really about positioning in such a way that the portfolio succeeds regardless of whatever the market does. We have to consider all of the different ways the market can play out from here and ensure we’re invested in such a way that our portfolio ultimately succeeds under each scenario.

So we’ll outline what we believe is the most likely way for things play out from here and how we plan to invest on an account of that outlook.

Scenario #1: market Correction Continues to Greater than 10% and/or To a 30-RSI on the QQQ

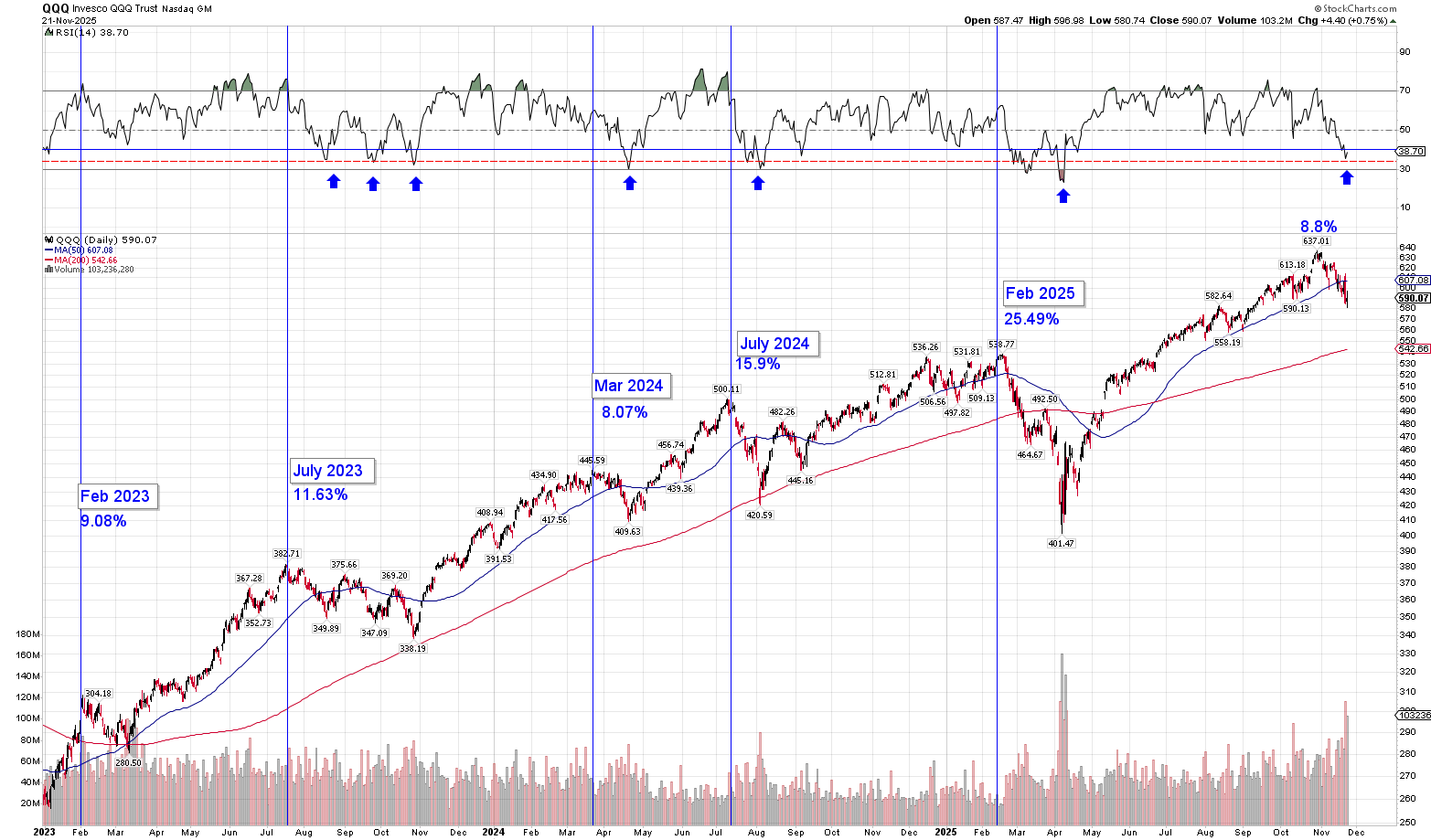

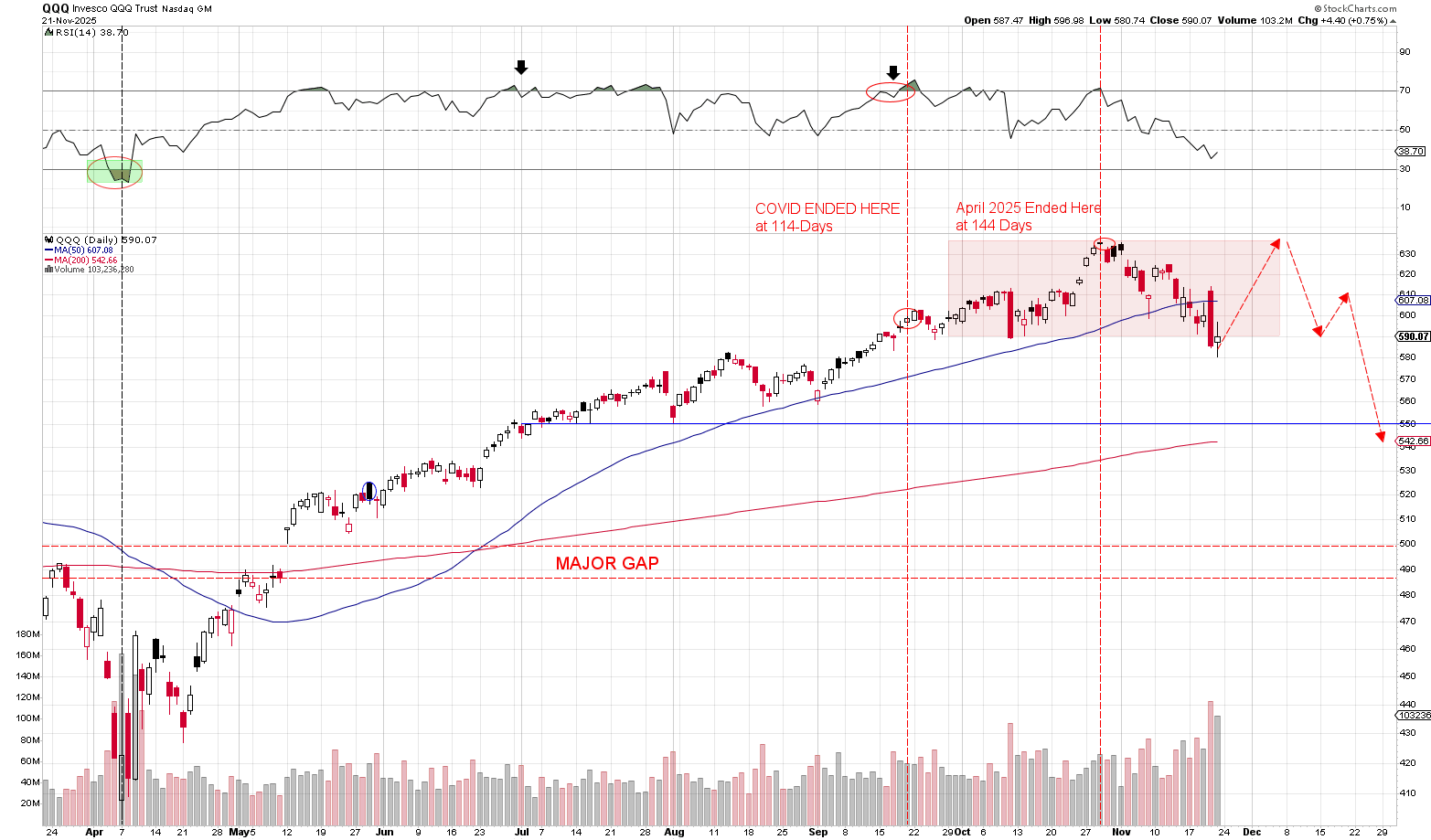

Scenario #1, is still the MOST LIKELY outcome right now. The QQQ has just ended a record breaking 144-session, 58.67% rally, from April 7, 2025 to October 29, 2025. The April – October rally was literally the THIRD largest rally in the QQQs’ entire history and the third largest NASDAQ rally going back to at least 1999.

We’re talking third behind the 110% dot-come rally of 1999 and the 84% COVID rally of 2020. Third largest rally ever on the QQQ. It is also the #1 LONGEST high volatility rally at 144-sessions, eclipsing the 2nd and 3rd longest rally (114-days) by a full 30-sessions. Notice that most high vol rallies end by Day 80-90. That’s as long as most high vol rallies go. This one went 50% longer than the standard rally and a full 26% longer than the prior record holders (2003/2020).

Point 1: Historically there’s an 80% Chance the Correction Extends to 11-12%

As a general rule, every single high vol rally that has exceeded 22% returns has dropped by 11.38% or more. The only exceptions to that rule has been the bear market recovery rallies of March & July 2009 and the bear market recovery rally of February 2003. That’s it. Then you have a two rule breakers including the Ben Bernanke sparked QE2 rally of August 2010, where the rally returned 26% over 52-trading days before sustaining a mere 5.89% correction, and the November 2023 to March 2024 rally that returned 30% ahead of a mere 8% correction.

Every other high vol rally that exceeded 22% returns resulted in an 11.38% decline. That’s the reality. And for the top rallies of all-time, the corrections are even larger than the typical 11.38% average.

The dot-com rally, for example, lead into a 40% decline over 40-trading days, the Covid rally lead to a 14.17% drop over 14 trading days and the Oct 2002 bear market rally of 45.68% lead to a 19% decline over 51 trading days. Those are the corrections that followed the other highest performing rallies of the past 26-years.

The next largest rallies after that are the March 2009 and Feb 2003 bear market bottoms. Literally the BOTTOMS of the two largest bear markets of the past century lead into rallies of 40.43% and 38.13% — much smaller than the current run — and in those cases we saw smaller 8.63% and 6.71% declines over 20 and 6 days respectively. Beyond that, the next three largest rallies went for 36.62%, 36.59% and 33.60% and lead to declines of 11.63%, 17.61% and 11.53%.

So when looking at the top 8 performing rallies going back to 1999, excluding this one, the QQQ declined by 11.63%, 17.61%, 11.53%, 19%, 40% and 14%. Those are the corrections that followed 6 out of the top 8 highest performing rallies. The two bear market recovery rallies both saw smaller corrections and then we have the current correction which stands at 8.8%.

The general rule derived from these observations is that, setting aside bear market recovery rallies, if the a high vol rally exceeds 22%, it generally leads to an 11.38%+ decline with only two true exceptions. In fact, even taking all exceptions into consideration, there were a total of 28 high vol rallies that exceeded 18% returns and only 6 of those had seen sub 11.38% correction. That means in total, even considering bear markets, and all other types of exceptions, every 4 out of 5 high vol rallies producing 18%+ returns resulted in a correction of 11.38% or greater. That’s a 20% risk of a sub-11.38% correction with most of those exceptions being bear market recoveries. Taking out bear market recoveries, it’s 1-in-10.

Okay. So with that in mind, the overall probability that this correction extends to >10% is high at 80-90%+. So far this correction has gone for 8.83% in total. That is why we believe that scenario #1 is the most likely outcome and that the QQQ should decline to at least $565 – $570 a share.

Point #2: The Daily RSI Still Not Low Enough

Every other correction of the current bull market era (2023-2026) has seen a lower daily RSI on a closing basis than this current correction so far. This is important because it indicates that we probably haven’t seen low enough prices just yet.

On a closing basis, the lowest the daily RSI has reached in this correction is 35.34. If the QQQ had closed at the lows of the day this past Friday, it would be a much different story. But because the QQQ closed up $4.40 on Friday, the lowest RSI close we’ve seen thus far is 35.34 on Thursday. Now let’s compare that to prior corrections to see where that fits in. Visually speaking, the red-line in the chart below shows how this correction would be the least oversold correction of the current bull market era if the correction ended last week:

So as you can see in the chart above, the red line represents the 33-RSI level and the lowest this rally has been on a closing basis was 35.34. Let’s see how that compares to prior corrections:

Current Correction (Nov 2025) = 35.34-RSI

February 2025 = 20-RSI

July 2024 = 20-RSI

March 2024 = 29.79-RSI

July 2023 Leg 1 = 34.76-RSI

July 2023 Leg 2 = 33.62-RSI

July 2023 Leg 3 = 32.20-RSI

As you can see, we’re close to some of the July 2023 legs, but even then in July 2023 the total correction was 11.63%. Also, in July 2023, while the first leg that only went down to a 34.76-RSI similar to the current correction, it also only lead to just a small 7.3% bounce ahead of another 7.6% leg down. So it’s not as if the market just up and bottomed at a 34.76% in July 2023. It lead to a continuation of the correction with an ultimate RSI low point of 32.20 on a closing basis.

From an RSI analysis point of view, the correction simply hasn’t gone far enough. Before there’s a serious risk of a bottom, the daily RSI needs to close around the 32-33 level at a minimum. If we go further back in time, that generally holds true through different eras.

Between 2020 and 2023, for example, the sole exception was the post Covid rally correction. But there, the QQQ literally peaked at an 80-RSI on the daily and declined 14% from that peak. The RSI declined 40 points from 80 to 40 on a significant 14% drop. In fact, during that era, every correction saw one of two things. Either a very low RSI or a great than 10% drop. Every single decline saw one of those two things at least if not both. Where we didn’t see both, you still saw a big decline and it generally followed a correction that had just occurred. Thus, every decline in the 2020-2023 era was marked by either or all of (1) a large decline 10%+, (2) a low 30-RSI or (3) a relatively large drop of 7.7%+ that followed closely after a full correction. What you didn’t have is an isolated drop of 8.8% where the RSI only reached 35 on a closing basis.

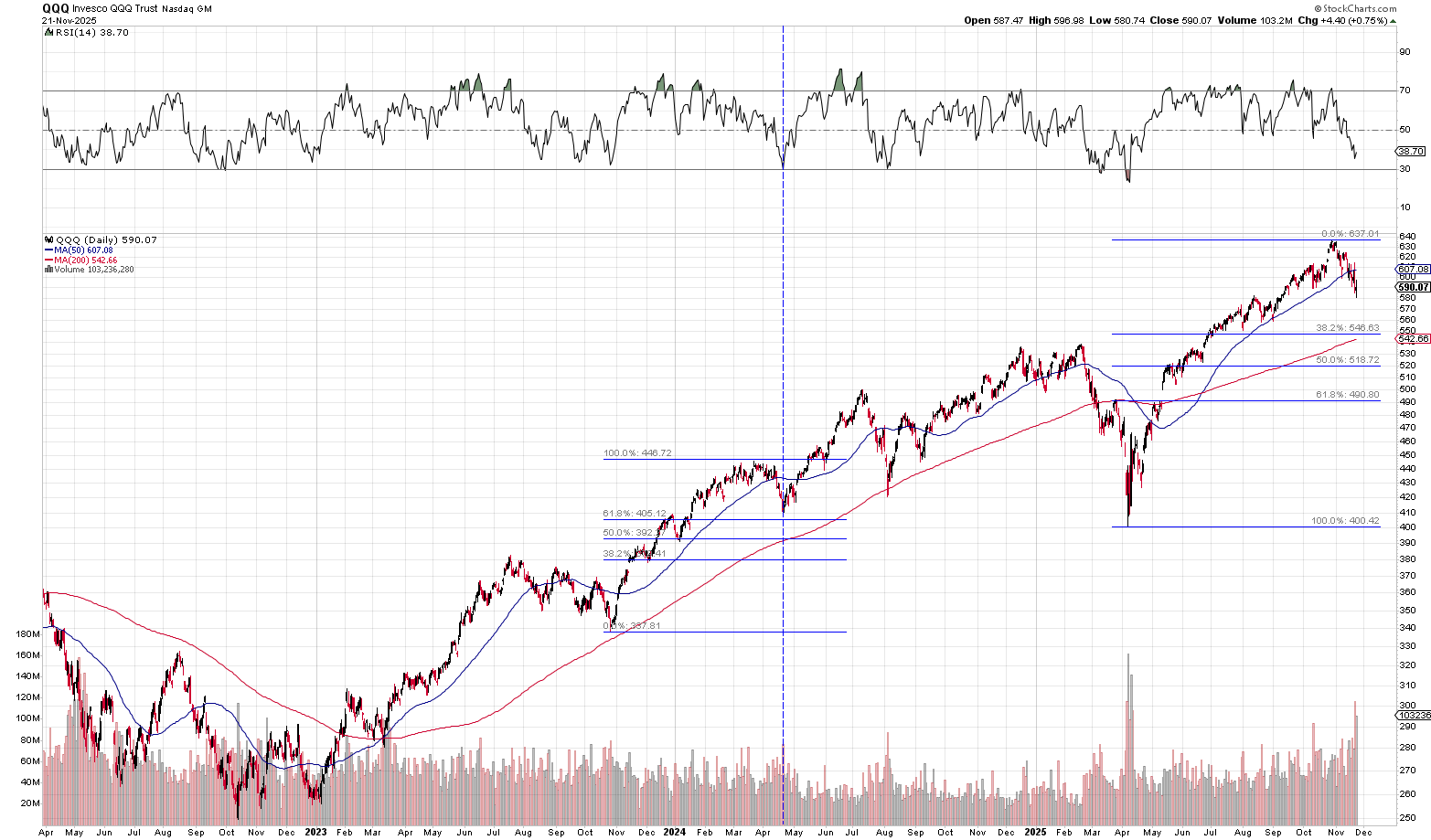

Point #3: Retracement Relative to the Rally is Far too Low

If the QQQ had bottomed this past week ahead of a new rally, it would make this correction the second smallest correction we’ve seen in the current bull market era AND on top of that, it would be a fraction of the typical retracement we generally see. The only 8% correction we’ve observed in the 2023-2026 era is the April 2024 correction following the 30% rally between November 2023 and March 2023.

Yet, a huge difference between that 8% decline and this current one is that at least the in the April 2024 correction the QQQ both (1) reached oversold conditions on the daily chart and (2) met the 38% retracement level before bottoming. Notice most rallies meet the 50% retracmenet market, generally giving back half of the gains of the entire rally, before bottoming. When that doesn’t occur, we at least see a 38% retracement.

Here’s, the QQQ is nowhere near its 38% retracement level which sits all the way down near $546.63 a share See below:

And related to this, from a pure visual point of view, this pull-back so far looks more like a small blip than a true correction. Because of the sheer size of the rally at 58%+, an 8% pull-back is going to look mild relative to the trend.

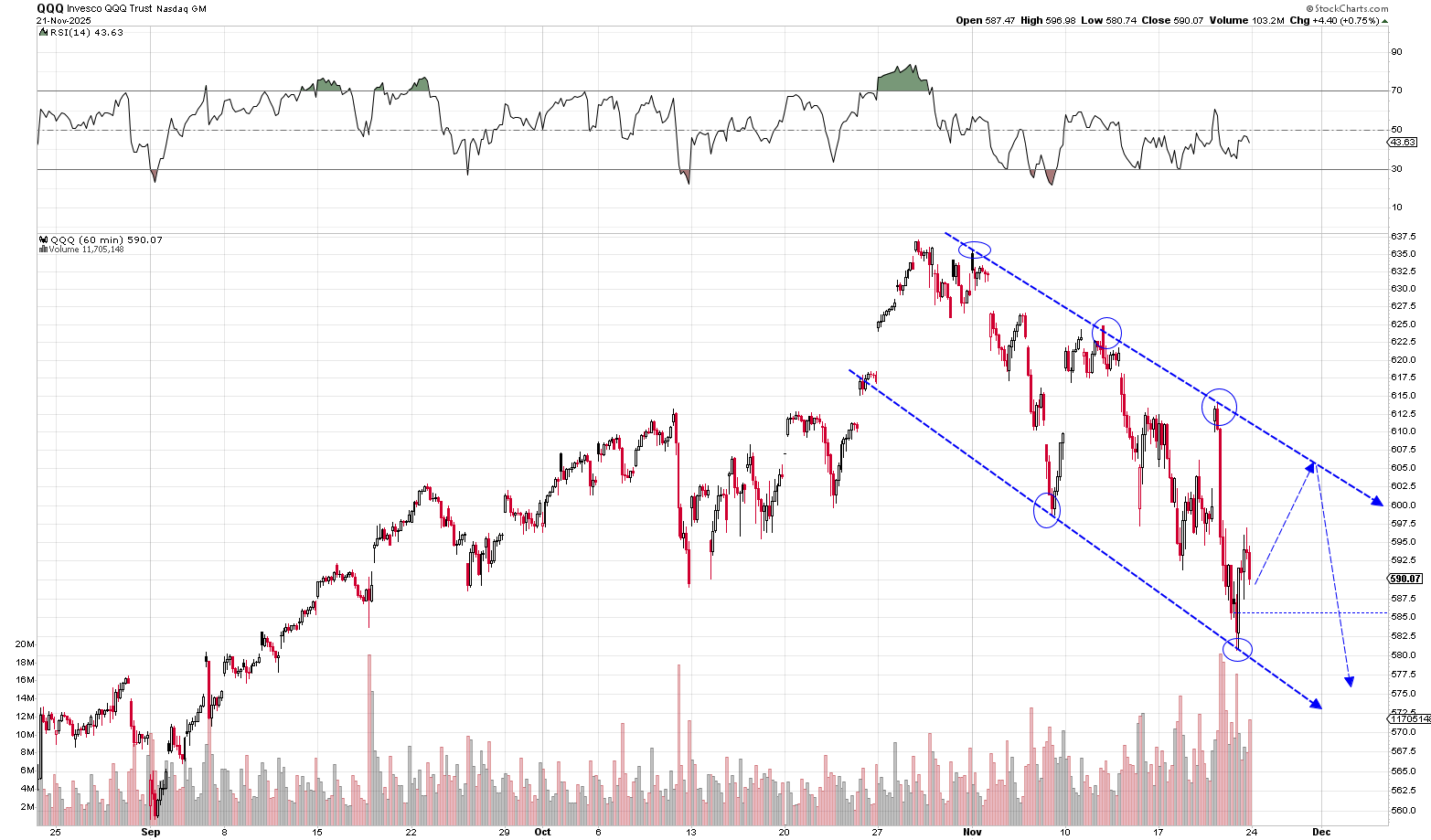

Point #4: Hourly Chart Points to More Downside Ahead

When looking at the hourly chart on the QQQ, nothing really points to the QQQ bottoming out last week. In fact, the rebound off of $580.74 looks very weak compared to prior rebounds. The QQQ fell from $614 down to $580 in a near straight line down, rebounded up to $596.98 and then quickly reversed course back down to close the session at $590.07. The QQQ is at a 43.63 RSI and has yet to reach oversold conditions at any point in this leg down. Leg 3 has not seen oversold conditions even once on the hourly.

As we noted last week, the rebound on the hourly really shouldn’t go beyond $600 and the maximum upside we have before there’s a breach in the upper trend line would be $605 as we cross the end of November. We don’t want to see a fast moving rebound back to the upper trend line and for a slower return trip, the maximum ceiling is around $605 by next Friday. If we see that type of a move, it keeps the window open for the next decline down to the low $570’s. Meaning, even if the QQQ rebounds, as long as the rebound is slow and methodical and as long as the QQQ doesn’t exceed $605 a share by any large margins, we should see a 30+ point 4th leg lower consistent with the trend:

Scenario #1: Overall Outlook & Conclusion

Under scenario #1, the QQQ can either (1) straight up continue lower after Friday’s last hour of trade where the QQQ reversed nearly 8-points to close out the session near $590 a share or (2) it could simply rebound up to $605, peak and then turn lower in a 4th leg down.

The QQQ could potentially gap-down on Monday morning and find its way down to the low $570’s. That’s one way for the correction to continue unfolded. Alternatively, the QQQ can continue its rebound up toward $605 that it started on Friday morning where it ultimately peaks again at the upper trend-line ahead of a fourth leg lower to $570 a share.

At $570, the total correction stands at 10.52% and there’s a good chance the QQQ would sit at oversold level on the daily at that point. Thus, scenario #1 is continue lower off of Friday’s final hour or rebound to $605 and then drop $35 down to $670. Leg 1 = $38.34; Leg 2 = $33.52; Leg 3 = $33.29 and Leg 4= $35.00 from $605. The rebounds were +27 for leg 1, +23 leg 2 and +25 Leg 3 if the QQQ tops at $605.

So all very consistent and fairly symmetrical. The evidence in support of this is outlined above. Let’s go to scenario #2 now.

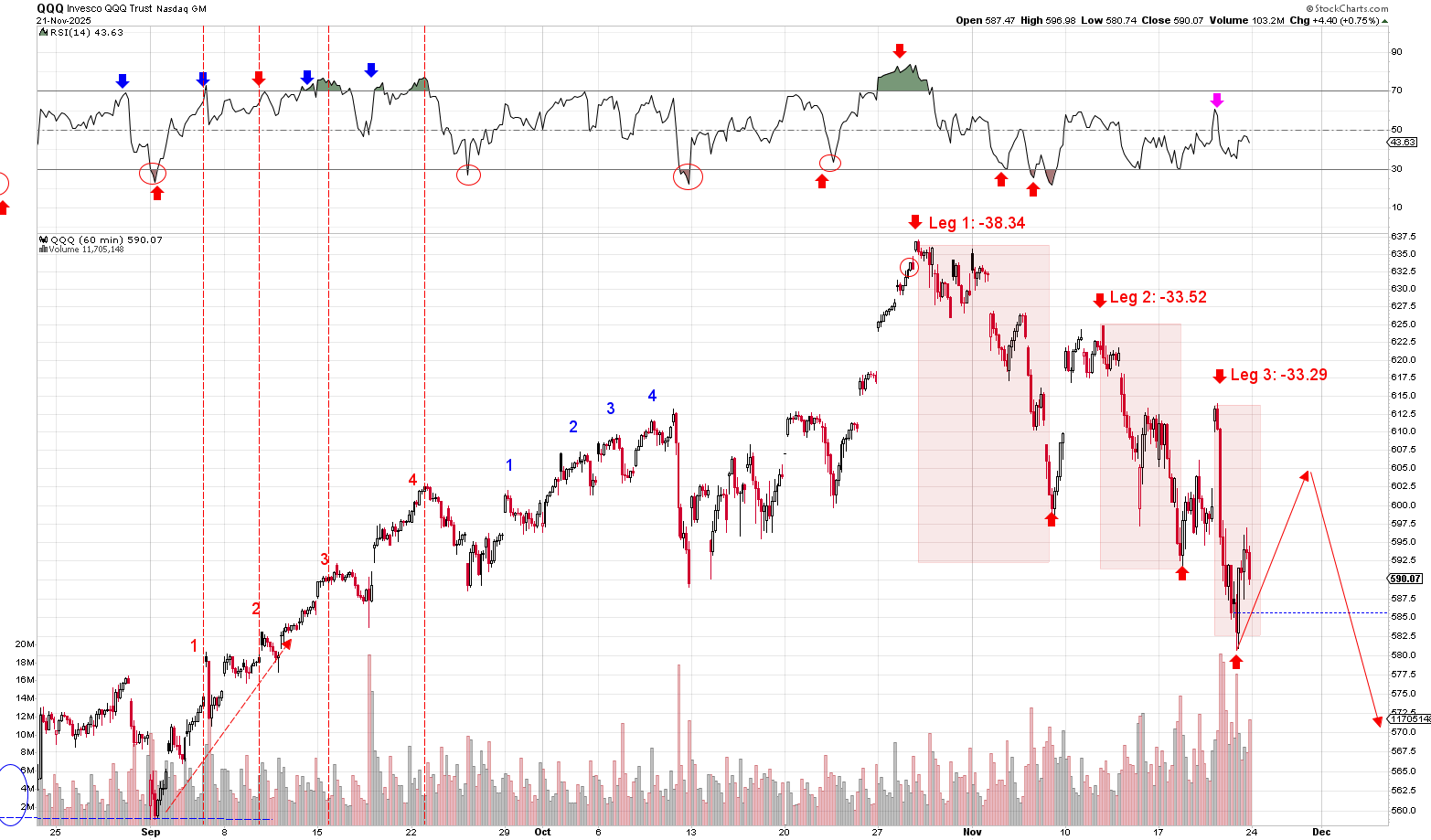

Scenario #2: Large Complex Top like Feb 2025

If you look back to December 2024 to February 2025, what you’ll find is the QQQ had sustained a 17-day decline that began in mid-December and ended in mid-January. We had a full correction — just like this current one — that prematurely ended at -7.17% and lead into a rally back to the highs.

During that 17-day decline, the QQQ fell from a high of $536.26 to a low of $497.82 where it then proceeded to embark on a 25-day & 8.23% rally back to $538.77 a share. At 8.23% returns, it was unclear whether that sparked the beginning of a new rally or whether it was a retest of the highs.

The total consolidation period lasted a full 42 trading days or 2-months (8-weeks). That consolidation then lead to the massive 25% correction that began at the end of February and bottomed on April 7. You can see the entire period below:

Now it’s important to point out that we’ve never seen the market form a complex top like this with such a wide range of trade spanning 40-points on the QQQ without it then leading into a massive sell-off.

But I can’t stress enough that scenario #2 is very complicated, has a lot of pitfalls and they’re notoriously difficult to predict as doubt and uncertainty clouds forecasting probabilities.

What makes these consolidation tops difficult to predict is that there’s no way to know whether the QQQ is going to simply top out once it reaches $538.77, as you see in the chart above or whether the QQQ might continue higher. It’s easy to look at this from the lens of retrospect. But at the time it was unfolding, when the QQQ reached $538.77 in February, there was the very real possibility that the QQQ could have broken out through $540 and onward.

If the QQQ had gapped up above $540 a share in later and then proceeded to run to $550 a share, then it would be a breakout that could still reverse course. There’s no clarity util there’s a full departure from the resistance zone.

There’s no way to know — until well after it happens — whether the QQQ is headed for a breakdown/collapse or a breakout/rally. What’s more, even if the QQQ declines upon reaching its highs at $637 — as it did in February — there’s no guarantee that we get a breakdown below the previous lows. And we’d need to wait until the breakdown happens to even be able to forecast the mere possibility of a larger sell-off.

What’s worse, back in February -March once the QQQ did actually breakdown below its $497 support, thereby indicating a full breakout, by that point it was getting close to reaching a 30-RSI and could potentially bottom at any time.

So while a large consolidation top does indicate a larger eventual sell-off, there’s doubt during the entire process. As the QQQ approaches $500 a share and $497 in March, the entire thought process at the time was “what if the QQQ simply holds support and now it forms the beginning of an inverse head & continuation pattern or a double-top breakout pattern. If the QQQ actually loses the $497.82 level, it’s going to almost certain soon reach oversold conditions which skyrockets the risk of a bottom way before it falls 25%.

Back in March, a breakdown below $497.82 setsa measured move downside target of -$40.95 below $497.82 or a target of $457. That’s what the chart says should happen on breakdown. But again, during that part of the decline under $497 and when the QQQ reaches oversold conditions, the risk of a bottom climbs daily.

The point is this. Applied to the current situation, if the QQQ managed to break through $600 and find its way back to the highs, the ensuing decline is going to be doubt filled and very difficult to navigate. It’s not a simple process and a return to $637 doesn’t guarantee a return trip back down to $570.

If the QQQ climbs back to $637 to form a double-top, then as Morpheus says, we’ll have a lot “fear, doubt and disbelief” to manage. But here’s how the QQQ could potentially form a double-top like we had back in Dec 2024 to Feb 2025:

Now here’s why scenario #2 is a very distinct possibility. So far, this correction has been on the waker side of the spectrum. We still haven’t seen any serious selling at this point and the QQQ continues to do nonsense things like reverse 30-points and then not sustain follow through. After Thursday’s massive reversal from $614 down to $584, we should have seen the QQQ close out Friday at $576 at least.

Under more normal conditions, we’d have easily seen the QQQ close out Friday at $568-$569. That’s because what would normally happen in a typical correction is we’d get a gap-down below $580 on Friday and then a slide throughout the day down to the low $573’s with panic driven 4-5 points of selling in the last hour to close under $570 — maybe at $568. That’s normal correction type behavior. Then on Monday you’d get a capitulation to end the correction or set-up a strong multi-week bounce. You might see $559 on Monday morning with a quick fill of the gap and a rally to close the day at $584 or something – that’s a 12.24% correction over 17-days. The QQQ might then slowly rally back to $600. That’s typical correction behavior.

But this nonsense of the QQQ rebounding off of $580 — not even oversold on the hourly — to then peak at $597 and reverse back down to $590 totally sets the QQQ up to go in either direction Monday. There’s definitely no sense of fear going into the weekend as there would be with the QQQ at $568.

The lack of any real fear so far sets this correction on a course toward potentially rebounding back to the highs to form a complex top like we saw back in January. So that’s one set-up we must address in our overall investment strategy because at best it’ll make things very unclear.

Scenario #3: Rally to $700 Ahead of a Collapse Down to $590

The third scenario we might see is a repeat of March-April 2024 where the QQQ simply prematurely bottoms at the $580 lows of last week and then proceeds to rally 20% up to $700 a share over he next 60 trading days. The rally goes from now until the end of February where the QQQ then collapses to $590 a share again. Note with this rally going to the mid-century mark, the next rally going to $700 regardless of starting point makes sense. $700 is our target after this correction ends.

Now I actually think this is the least likely scenario as of now because of the RSI analysis. The Daily RSI just hasn’t gone far enough to set-up a larger rally. But it is a risk we must consider in our overall strategy.

The good news is that we generally get a fairly clear indication of a new rally via the momentum. Usually, when a new rally begins, the momentum is very powerful. This is especially the case in the early stages of the rally. If we go back and look at every previous bona fide intermediate-term rally, that first segment is very explosive on the order of around 10-15%. For example, in the first 16 trading days of the April 2024 – July 2024 rally, the QQQ went from $418 to $455 as it Mae fresh all-time highs in just 3-weeks. That’s an 8.9% first segment. Segment 2 pushed into deeply overbought territory as did segment 3.

So a big tell would be an explosive multi-week run putting the QQQ at $650 a share. That would be the equivalent move to what we saw off of the lows in April 2024. But again, that April rally began after the QQQ had closed at a 29-RSI on the daily. We don’t have that here.

So I’d say unlikely but still largely a scenario at play here.

So when crafting our investment strategy as we head into the next few weeks, those are the things we need to be thinking about. What evidence do we have indicating we should see an 11% correction before this is over and does the trading action comport with that? If we don’t see a 11% correction, what is the likelihood that we form a large complex double-top with a collapse in January. Is there any evidence that we may see a repeat of March 2024 despite the QQQ not reaching oversold conditions. Those are the risk variables. How we position should address those risks at some level.

We discuss that in the November 2025 Investment Strategy article.

In my very naive view and not all backed up by any evidence it seems that there is and has been a lot of buying pressure the last half year. Every dip gets bought up aggressively and even this “correction” seems to have real trouble getting going with these big rebounds. Is that something you see ass well, or have you got any thoughts about that?

Not that that is anything one could base investment decisions on i guess..

Yeah it seems like it stops just short of where you would expect it to give way, but the (albeit short) periods of selling have also been brutal. There was that huge intra-day reversal on Thursday and even though the retracement went above 50% on the first couple legs the market still ended up going down for another leg.

Seems like it’s aggressive in both directions for short bouts and neither side has been able to break through (either for a breakdown to true correction level selling or a breakout back to highs)

Yes. Your senses are right. When corrections happen, they’re supposed to go too far, not fall short. Generally, you get overshoot in the selling. And we haven’t quite had that here just yet.

But that does eventually come. It just means what we’re seeing right now is more akin to December-January than it is a true correction.

The good news is we have a good blueprint on exactly how to trade and what to do. If the QQQ keeps moving higher and reaches overbought, we’ll buy back our puts that we sold and maybe even add more since we own long leap to hedge.

If the QQQ stocks and rolls over, well then we can add to our long position. Any big move one way or the other will dictate what we do.

aggressive buying this morning. Touching the 55 RSI on the hourly. But last time that happened, it still dropped.

I wonder if we will see 2 exceptions to the usual rule this go around.

If you mean the rule that 22%+ high vol rallies generally lead to 11.38%+ corrections, then this would be the third exception. It would be scenario #3 we outlined. And in those two case where there was an exception, the next correction was especially brutal. So we could be there. We won’t know until the QQQ actually take out it prior highs and how it returns to those highs matters a lot.

Today’s action doesn’t really tell us much at this point.

QQQ just hit 605. I guess we’ll see if it reverses or breaks out

Yeah at $605, the rebound is $25 now. Which is in-line with the previous rebounds. So we’re in a place where we do need to start seeing some selling pressure. If the QQQ moves much higher, then it starts to look like a full reversal of the $614 to $580 drop. That’s way $605 is a line in the sand because any higher and we have a retracement that goes too far.

With BTC down 30% from its highs do you see any opportunities there?