Samwise Model Portfolios

The portfolios below are separated by launch dates. Each portfolio is entirely independent and has no bearing on any other model portfolio. We launch entirely new portfolios during each market correction as an illustrative tool for new subscribers who weren’t present during the previous buying opportunities in the market. To date, we’ve launched four portfolios during two separate corrections.

Please login to view the Samwise Portfolio.

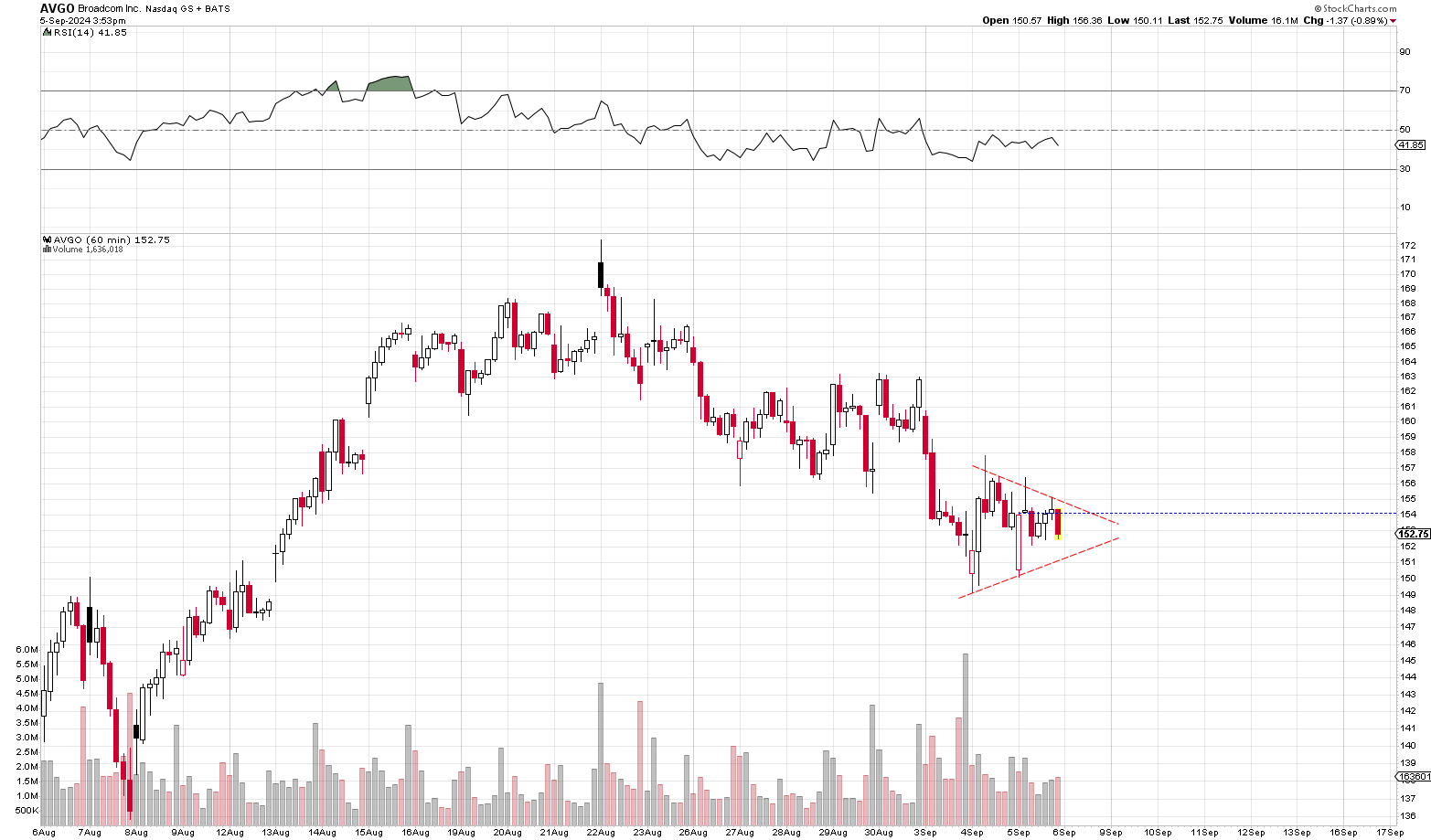

11:25 AM EST: Broadcom (AVGO) earnings to dictate direction Heading into next week

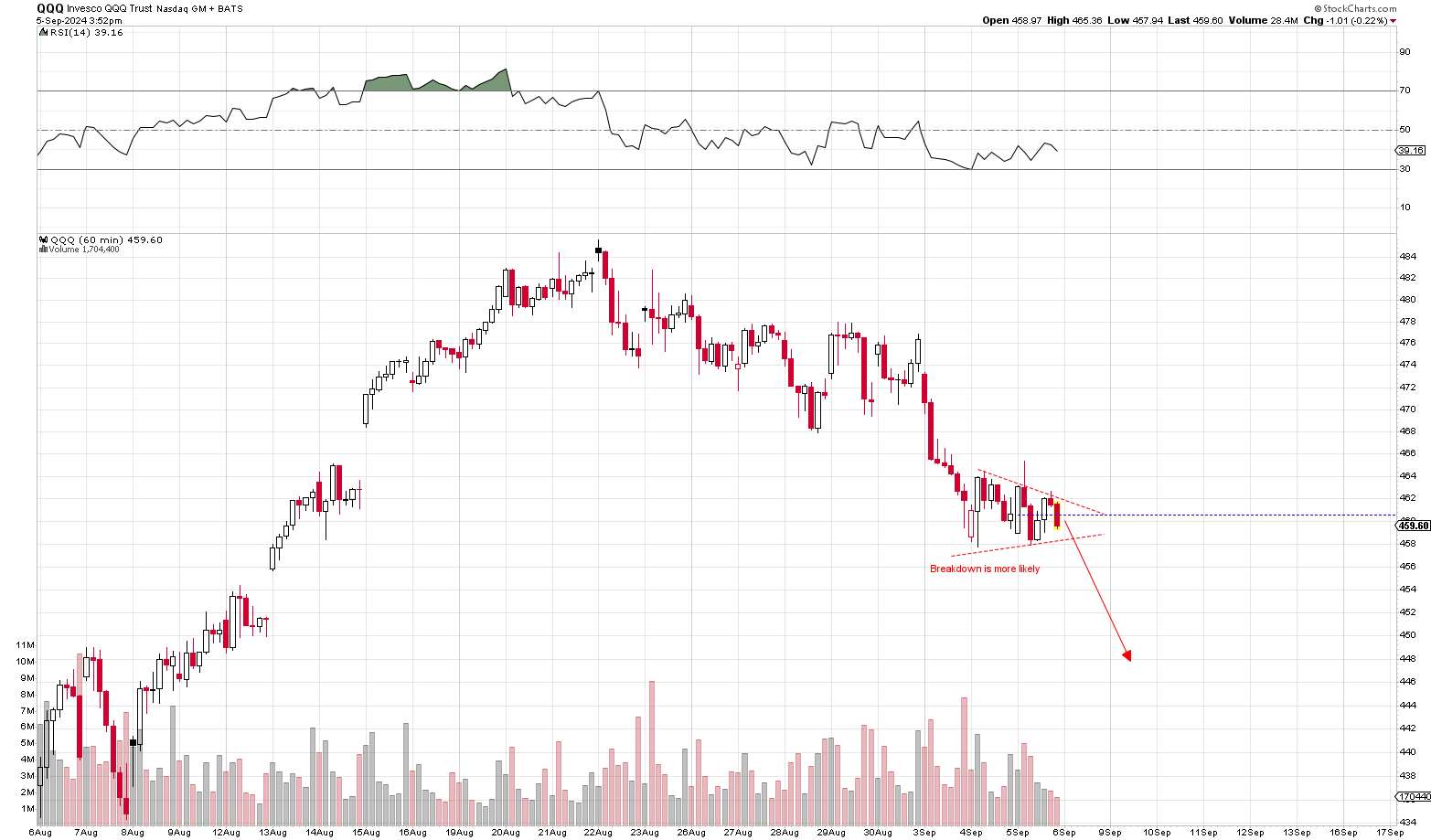

With the market up today on a far weaker than expected ADP report, it tells me that weaker data is starting to get priced in a bit. ADP is often a window into the more widely watched employment report. That being said, I Broadcom’s earnings may have a bigger impact in terms of the near-term direction for tech stock. Especially given how weakly the NASDAQ-100 and Nvidia are trading off of their oversold conditions.

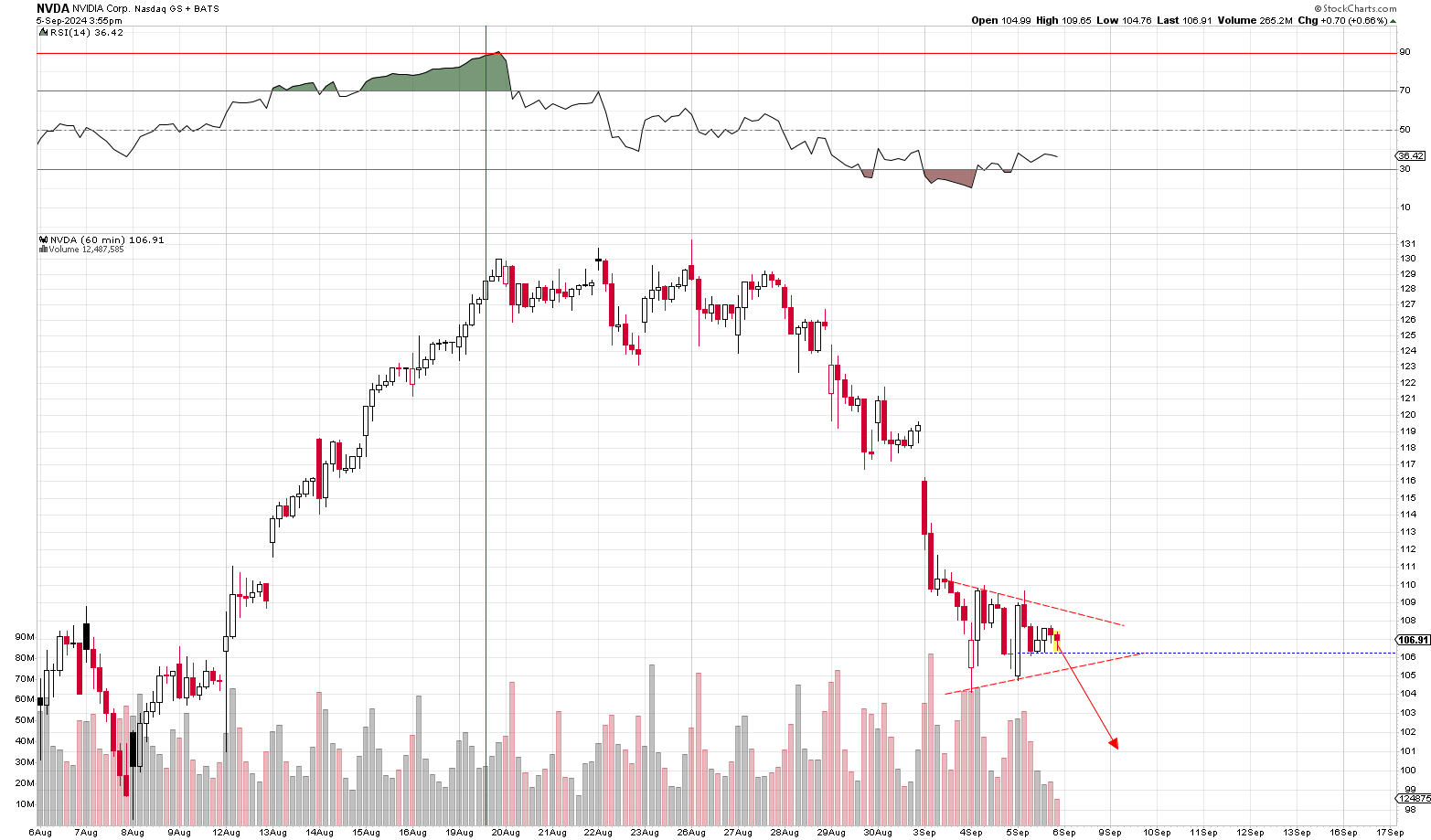

Nvidia (NVDA) pushed way down into extreme oversold territory and has barely even bounced at the point. The entire rebound off of $104 has been very anemic compared to what we’ve seen out Nvidia in the past and compared to what we should normally see when a stock like Nvidia becomes that oversold.

That tepid move off the lows suggests that buyers are still very tentative and waiting for Broadcom, the jobs report and inflation next week. We actually have quite a few catalysts coming up over the next 7-8 trading sessions as the fed is up to bat right after next week’s data. We also have Apple announcing its Ai-powered iPhone 16 which could move the markets depending on the quality of the announcements.

The Intermediate-Term is still Bullish

While the near-term may be a little uncertain given the wide range of catalysts coming up over the next 8-9 days, it’s important to keep a broad perspective on things. The overall big picture is still vey bullish for a wide number of reasons.

First, Nvidia (NVDA) being 25% off of its all-time highs coupled with the fact that we’re trading near the $90-$105 range tells us that we’re right near the trading lows. Nvidia may spend some time consolidating, doing some technical testing and retesting here, but we’re likely going higher right after all that is done with in the weeks and months ahead.

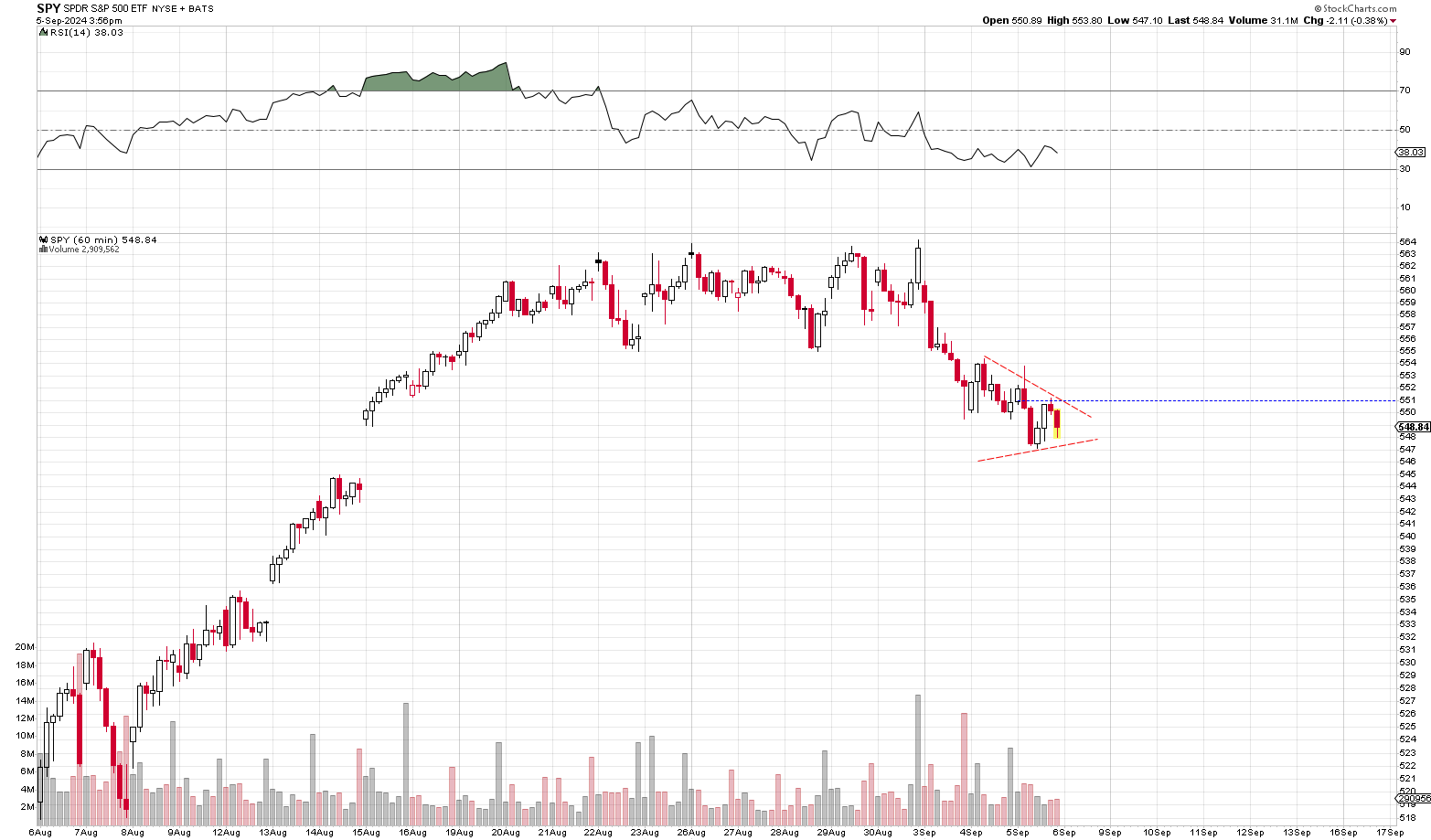

Second, it’s important to remember that while tech is underperforming right now and has a bit of a bearish sentiment driving things, the broad S&P 500 is still very much bullish across all time-frames. The SPY went into the week near its all-time highs and is still barely just off of them. We’re talking a mere 2.65% off of its ALL-TIME highs. That’s still very bullish. Also, the technical formation on the SPY couldn’t be stronger. It is forming a cup & handle type of formation which is generally bullish. While the NASDAQ-100 has given up nearly 6% of its gains and entered in to what has historically constituted a small correction, the SPY has only seen a minor pull-back at this point.

The reason this is important is because the broad market across all sectors on average is still on a bullish heading. If the market begins to rally again, that’s going to put upside pressure on tech and eventually re-ignite the tech rally. In fact, with as much as tech is down relative to the S&P 500 and given tech’s weighting in the index, it’s likely that tech is what is driving the entire pull-back on the S&P instead of bearish economic sentiment.

To sum up on where things stand right now, we’ve yet to see any kind of real rebound off of oversold condition. The markets are in a wait and see stance at the moment given Broadcom, given the employment report tomorrow, given inflation data being released next week. At the same time, as oversold as Nvida (NVDA) has become, it’s due for a big rebound. If Nvidia (NVDA) takes another leg lower toward the $97-$103 range, it’s likely falls back into oversold territory and will likely then see a massive bounce post-data releases.

On the DITM calls the profit is when you exercise them correct?

So do you always execute DITM calls if they are above the strike price?

No. Not at all. Think of them as a separate regular asset. We never exercise options at all. But there is one strategy where you definitely can do that and it would be in the stock-substitution strategy outlined here:

https://sam-weiss.com/investing-basics/inherent-leverage-3/

If you scroll down to the next slide, it coves that idea a little. But here at Sam Weiss, we’re never going to exercise. When we buy DITM calls, it will be with intention of selling the calls down the line at a higher price.

With call and put options, you can buy them and can sell them as freely as you would NVDA common stock. They’re just a little less liquid and sometimes the bid/ask spread can be wide. Especially in some options that are lightly traded. With popular stocks like NVDA, the bid/ask spread is relatively tight allowing investors to buy and sell them teh same way they might buy and sell a stock.

In the 25-years I’ve been invested in the market, I can count on 1 hand the number of times I’ve ever exercised an option. I know it has happened before, but I’m rarely delving into a strategy that requires exercising.

Isn’t it likely that we won’t see the bottom until October, as September tends to be a bad month for stocks?

AVGO reported upbeat earnings (topline, bottom-line and outlook) yet stock is down 5%. Given this, would you expect a breakdown to new lows tomorrow if the job report isn’t stellar?