I posted a question (https://sam-weiss.com/market-approaching-key-resistance-nvidia-nvda-reaches-key-levels-representing-a-full-bottom-for-the-stock/#comment-1761) asking you to explain your mental model and step-by-step framework on determining the nuts and bolts of the QQQ hedge placed in the Stark portfolio on February 6th 2025. Your answer to my question was extremely insightful and I’ve linked the comment for other subscribers to review in the future. I’m reposting my question here so your answer doesn’t get lost in the Daily Briefing article since they’re time sensitive and easily lost in the weeds.

As we pointed out in yesterday’s session, today marks Day 32 of the corrective period which puts this correction at the higher limit of the duration spectrum. This correction, when all is said and done, could easily surpass every previous correction except for November 2022 which really was three separate correction followed by three major rallies. That one unfolded very differently than what we’re seeing today in that the moves were far bigger. Instead of 5-6 legs like we had here, we had three large down legs each greater than this correction and two major rebounds substantially larger than any rebound we’ve seen here. This all unfolded over a period of several months. Whereas this corrective period has lasted about a month and a half now. So very different environment where each leg down and up were drawn out lasting weeks. Here, the QQQ can’t seem to string more than 2-3 up or down days together.

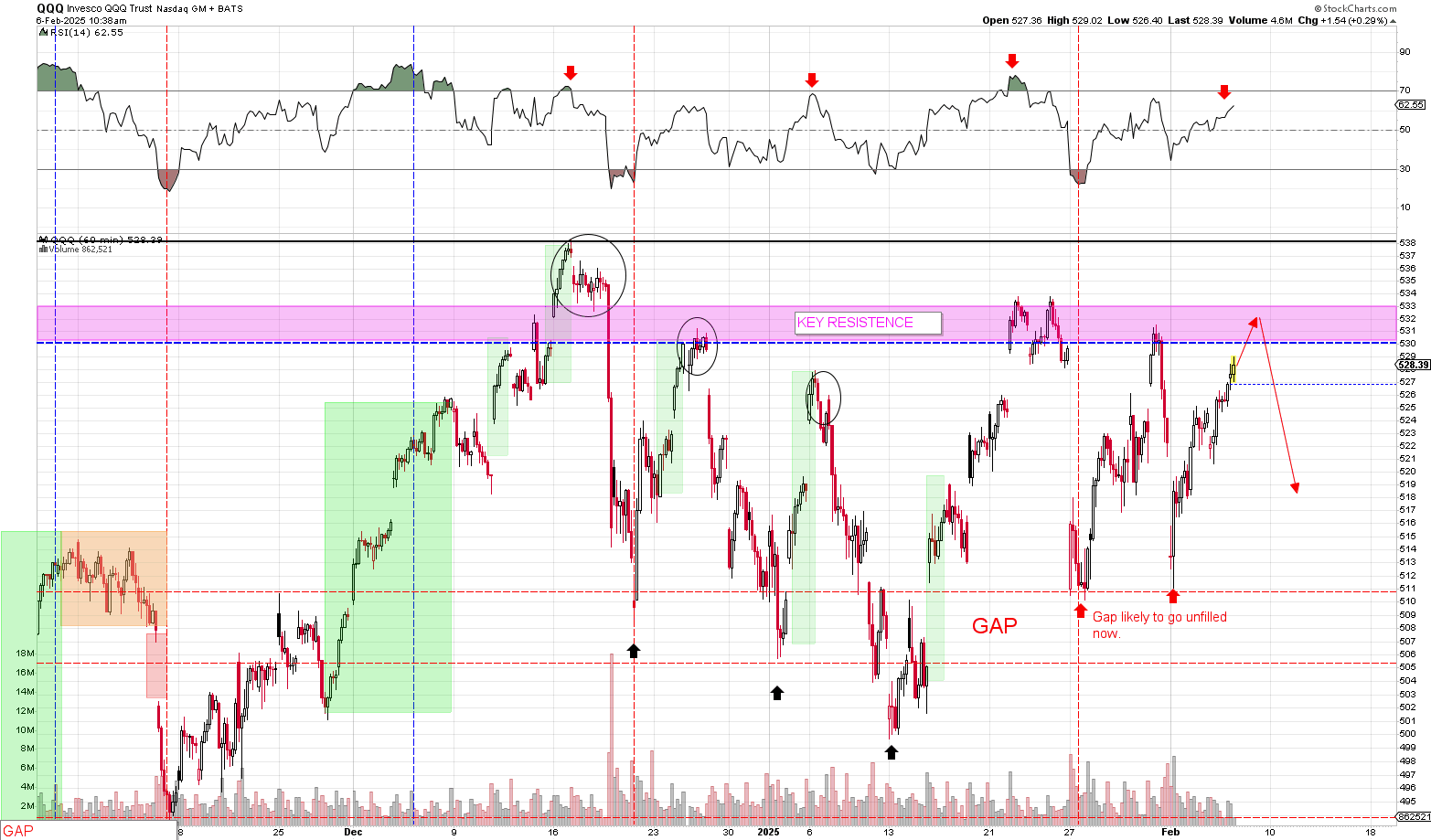

The hourly QQQ chart during this time period can be found here:. I’ve attached an image of the Stark portfolio after the hedge was placed for future readers.

Question

Could you explain your mental model on the strike and expiration date for the QQQ Jan 2026 $500 PUT options you purchased in the Stark portfolio? If you could provide a step-by-step framework one could use to determine future hedges that would be immensely useful.

Much appreciated!

Can’t thank you enough for all the guidance you’ve provided since becoming a subscriber :).

How to Construct an Effective Hedge

When putting together a hedge, you need to run different hypotheticals.

• What exactly are we protecting against?

• What is our biggest concern?

• What doesn’t matter all that much?

In this case, we’re primarily concerned about a 2022-style bear market or a 2008-type financial crisis. We’re not worried about a basic 10-20% correction that will be recovered anyway.

If a bear market happens, we would expect QQQ to decline by 40-60%.

• In 2022, QQQ dropped from a high of $408 to a low of $250, a 39% decline over 6-10 months.

• If we apply that to today, a similar 39% drop from QQQ’s current high of $539 would bring it down to $330.

——–

Impact on Our January 2027 $500 Calls

We own 3 contracts of the January 2027 $500 calls, purchased in Stark for $25,260 ($85 per contract).

To estimate what happens to these calls in a crash, we use an options calculator like this:

Adjustments in the Option Calculator for the Crash Scenario:

1. Increase volatility to 35% → Volatility spikes in bear markets so we increase volatility in the options calculation.

2. Reduce time until expiration by ~6 months → Since we expect the crash to take time to unfold, we reduce the number of days in the option calculator. We then compare the final price to an option TODAY that would be similarly out of the money with the same time to expiration. For example, the $670 June 2026 calls are $170 out of the money and have similar time remaining until expiration. That comparison helps give us a comparison to the option calculator results.

Based on this:

• If QQQ drops to $330 over 230 days and volatility rises to 35%, the calculator estimates our calls would drop from $85 to $15 per contract.

• That’s a loss of $70 per contract x 3 contracts = $21,000 total loss.

The $670 June 2026 Calls are $10.00 without the increase in volatility. So the option calculator is right.

——-

So How Do We Hedge This Loss?

Now that we know our $25,000 long position could experience a $21,000 loss in a bear market, we need an effective and cost-efficient way to protect against that. We can’t pay for too much or too little insurance. Too much insurance eats into our profits. Too little and we can get crushed in a bear market.

Since we own the $500 calls, we start by looking at the $500 puts. The key is:

• Buying puts each year to hedge our position.

• Selling premium to cover the cost of the puts so protection remains affordable.

• Avoiding excessive protection that eats into profits.

——

Evaluating the $500 Puts

Today, the $500 puts cost $24.15 per contract.

Let’s first consider buying 3 contracts (to match our 3 calls):

• 3 contracts at $24.00 = $7,200 total cost.

• If QQQ rallies to $600 instead of crashing, we would lose this full $7,200.

• Our long position is $25,260, meaning we would need to generate at least a 28.5% return just to break even.

Let’s see what happens if QQQ actually crashes to $330:

• At $330, the $500 puts would be worth $170 intrinsically.

• So, $170 – $24 = $146 profit per contract.

• $146 x 3 contracts = $43,800 in profit.

That’s way too much protection—we only need to hedge a $21,000 loss.

How to Make the Hedge More Affordable

• Cost of 2 contracts = $4,800 ($24 x 2 contracts).

• We can offset this cost by selling covered calls throughout the year.

• If we can reduce the net cost to $2,000, we’ll still profit massively if QQQ rallies to $600.

Final Takeaway: Running the Math is Essential

This is how you systematically determine the right hedge:

✔️ Run bear market scenarios using historical declines.

✔️ Use options calculators to estimate the impact on existing positions.

✔️ Identify the right number of put contracts to match expected losses.

✔️ Offset hedging costs with strategic premium selling.

Each year, this process needs to be re-evaluated to ensure the hedge remains cost-effective without sacrificing too much upside.

——–

Edit: Down the line we’ll come back around and try to build this into a new Chapter segment.

A follow up question: say at one point the market goes bear: with 2 puts, what would be your criteria/indicators to sell 1 or both of these puts? Bear markets are somewhat difficult to read aren’t they?

Deeply oversold conditions on the daily chart in addition to down significantly. So for example, in the 2022 bear market, we probably wouldn’t pull our hedges until the QQQ had fallen under $300 a share. It topped at $408, fell under $300 eventually reaching deeply oversold conditions. A t that point, we’d start to think about the future. We’d starting buying long term positions and reposition for the next bull market.

In the worst bear markets, the stock market drops 50%. That’s the absolutely worst. So if we’re down 30-40%, it’s time to start transitioning at that point. During a bear market rally, we re-hedge.

The key here is the percentage loss. we’re not going to sell our puts in a mere 10% correction. we need to see very heavy selling with the QQQ down 25-30-35% before we transition. That’s the key. And really it will be percentage loss + key indicators like oversold $NYMO, overbought $VIX and deeply oversold daily RSI. We FOUR different 10%+ rallies in the 2022 bear market with one going for 17% and another for 26%. Those are HUGE rallies.

When things slow down, I am very interested in this new chapter segment especially because it;s clear when at or near the bottom. Not so clear when to put on a hedge. I was looking at April 15, 2025 daily briefing when you put on hedges with QQQ @ ~$465, aside from a big move up from $402, it wasn’t actually overbought IIRC, but proceeded down again not long after. This makes putting on hedges very very hard. You even mentioned on that day, you might be early but were getting antsy.

So the hedge that we put on at 465 was absolutely necessary and even knowing what we know now we would definitely have to do it

The 465 level, particularly the 467 level, was a very big level of resistance because of the gap. That was the gap created by the liberation day nonsense.

So it was a level where, if the QQQ was in a bar market, that was a place where it was logically top

Now, when we buy that hedge, we are buying it specifically to allow us to continue holding the position up to where it is now.

While it did eat into our profits by a very tiny amount, it is precisely what made us comfortable, holding the position all of this time.

No hedge, and we would sit there and wonder whether the market was peeking every day

We didn’t have to do that because we were hedge.

The cost that we paid again, very small relative to gains, allowed us to continue to participate to the upside with total peace of mind.

Now that we’ve climbed to 520 we have to consider hedging again to protect our profits that we just made.

Here’s how we do this. Once the QQQ test it’s all-time highs, which is now pretty inevitable, we will sell premium against our position and use that premium to purchase puts

That way, if the QQQ tops and has a major correction, we are protected.

If the QQQ continues to rise to 600 to share, our premium probably caps us at $600 anyway.

For example, when we get to 540 we will look to sell the 580 calls hopefully for around $15-$20

Meaning, we get to participate up to $600.

This is gonna play out differently in every correction and under different circumstances

But the general idea is the same.

For example, in August, we bought the QQQ and Nvidia during the August capitulation day. August capitulation played out very similarly as April 7 capitulation. We had the same rally afterward.

And like the April 7 capitulation, we waited to hedge near the previous highs at around 480 share.

We hedged again a second time at 540.

That’s how it’s always going to be. We did the same thing in Lannister and To a certain degree. We did the same thing with Stark.

The strategy is to buy at extremely, wait for a rebound and then hedge.

Where to hedge exactly is entirely market dependent. It is specific to each environment.

Often times we’re going to hedge at critical areas of resistance Places where the market might peak.

467 a share was a major area resistance for the NASDAQ 100. That was the reasoning for why we hedged when we did. And that hedge was intended to protect our position, and to ensure that if there was a crash that we would capitalize.

Notice that Arryn purchased double the hedge and was sitting at $160,000. Here we are at 5:20 and Erin has risen a 240,000. So we’ve made about $80,000 or 80% relative to our cost basis even having double the hedge.

So he didn’t really eat into our profits all that much.

I get it in real life. It hurts to see those numbers. I was just talking to my wife about that yesterday. Like I look at my account and I cringe when I look at my hedges. But it’s absolutely necessary.

Hi Sam!

I posted a question (https://sam-weiss.com/market-approaching-key-resistance-nvidia-nvda-reaches-key-levels-representing-a-full-bottom-for-the-stock/#comment-1761) asking you to explain your mental model and step-by-step framework on determining the nuts and bolts of the QQQ hedge placed in the Stark portfolio on February 6th 2025. Your answer to my question was extremely insightful and I’ve linked the comment for other subscribers to review in the future. I’m reposting my question here so your answer doesn’t get lost in the Daily Briefing article since they’re time sensitive and easily lost in the weeds.

Context / Timeline

On January 13th, 2025, you purchased QQQ JAN 2027 $500 CALLS and outlined your reasoning in your Daily Briefing article (https://sam-weiss.com/market-likely-nearing-a-near-term-low-as-it-sells-off-into-inflation-data/). Here is the Trade Alert of the purchase for extra detail on the premium, time of purchase, and allocation size: https://sam-weiss.com/trade-alert-trades-executed-in-stark-portfolio/.

On February 5th, 2025, you called out in your Daily Briefing article (https://sam-weiss.com/nasdaq-100-trading-action-slightly-raises-potential-bear-market/) how the price action and duration of the consolidation period in QQQ raises alarms for a potential bear market:

On February 6th, 2025, you purchased QQQ JAN 2026 $500 PUTS to hedge (https://sam-weiss.com/trade-alert-hedges-places-in-stark-frey-portfolios/) against a potential bear market and you outlined your reasoning in your Daily Briefing article (https://sam-weiss.com/market-approaching-key-resistance-nvidia-nvda-reaches-key-levels-representing-a-full-bottom-for-the-stock/).

The hourly QQQ chart during this time period can be found here: . I’ve attached an image of the Stark portfolio after the hedge was placed for future readers.

. I’ve attached an image of the Stark portfolio after the hedge was placed for future readers.

Question

Could you explain your mental model on the strike and expiration date for the QQQ Jan 2026 $500 PUT options you purchased in the Stark portfolio? If you could provide a step-by-step framework one could use to determine future hedges that would be immensely useful.

Much appreciated!

Can’t thank you enough for all the guidance you’ve provided since becoming a subscriber :).

How to Construct an Effective Hedge

When putting together a hedge, you need to run different hypotheticals.

• What exactly are we protecting against?

• What is our biggest concern?

• What doesn’t matter all that much?

In this case, we’re primarily concerned about a 2022-style bear market or a 2008-type financial crisis. We’re not worried about a basic 10-20% correction that will be recovered anyway.

If a bear market happens, we would expect QQQ to decline by 40-60%.

• In 2022, QQQ dropped from a high of $408 to a low of $250, a 39% decline over 6-10 months.

• If we apply that to today, a similar 39% drop from QQQ’s current high of $539 would bring it down to $330.

——–

Impact on Our January 2027 $500 Calls

We own 3 contracts of the January 2027 $500 calls, purchased in Stark for $25,260 ($85 per contract).

To estimate what happens to these calls in a crash, we use an options calculator like this:

https://www.barchart.com/options/options-calculator

Adjustments in the Option Calculator for the Crash Scenario:

1. Increase volatility to 35% → Volatility spikes in bear markets so we increase volatility in the options calculation.

2. Reduce time until expiration by ~6 months → Since we expect the crash to take time to unfold, we reduce the number of days in the option calculator. We then compare the final price to an option TODAY that would be similarly out of the money with the same time to expiration. For example, the $670 June 2026 calls are $170 out of the money and have similar time remaining until expiration. That comparison helps give us a comparison to the option calculator results.

Based on this:

• If QQQ drops to $330 over 230 days and volatility rises to 35%, the calculator estimates our calls would drop from $85 to $15 per contract.

• That’s a loss of $70 per contract x 3 contracts = $21,000 total loss.

The $670 June 2026 Calls are $10.00 without the increase in volatility. So the option calculator is right.

——-

So How Do We Hedge This Loss?

Now that we know our $25,000 long position could experience a $21,000 loss in a bear market, we need an effective and cost-efficient way to protect against that. We can’t pay for too much or too little insurance. Too much insurance eats into our profits. Too little and we can get crushed in a bear market.

Since we own the $500 calls, we start by looking at the $500 puts. The key is:

• Buying puts each year to hedge our position.

• Selling premium to cover the cost of the puts so protection remains affordable.

• Avoiding excessive protection that eats into profits.

——

Evaluating the $500 Puts

Today, the $500 puts cost $24.15 per contract.

Let’s first consider buying 3 contracts (to match our 3 calls):

• 3 contracts at $24.00 = $7,200 total cost.

• If QQQ rallies to $600 instead of crashing, we would lose this full $7,200.

• Our long position is $25,260, meaning we would need to generate at least a 28.5% return just to break even.

Let’s see what happens if QQQ actually crashes to $330:

• At $330, the $500 puts would be worth $170 intrinsically.

• So, $170 – $24 = $146 profit per contract.

• $146 x 3 contracts = $43,800 in profit.

That’s way too much protection—we only need to hedge a $21,000 loss.

How to Make the Hedge More Affordable

• Cost of 2 contracts = $4,800 ($24 x 2 contracts).

• We can offset this cost by selling covered calls throughout the year.

• If we can reduce the net cost to $2,000, we’ll still profit massively if QQQ rallies to $600.

Final Takeaway: Running the Math is Essential

This is how you systematically determine the right hedge:

✔️ Run bear market scenarios using historical declines.

✔️ Use options calculators to estimate the impact on existing positions.

✔️ Identify the right number of put contracts to match expected losses.

✔️ Offset hedging costs with strategic premium selling.

Each year, this process needs to be re-evaluated to ensure the hedge remains cost-effective without sacrificing too much upside.

——–

Edit: Down the line we’ll come back around and try to build this into a new Chapter segment.

Excellent writeup from both of you.

A follow up question: say at one point the market goes bear: with 2 puts, what would be your criteria/indicators to sell 1 or both of these puts? Bear markets are somewhat difficult to read aren’t they?

Deeply oversold conditions on the daily chart in addition to down significantly. So for example, in the 2022 bear market, we probably wouldn’t pull our hedges until the QQQ had fallen under $300 a share. It topped at $408, fell under $300 eventually reaching deeply oversold conditions. A t that point, we’d start to think about the future. We’d starting buying long term positions and reposition for the next bull market.

In the worst bear markets, the stock market drops 50%. That’s the absolutely worst. So if we’re down 30-40%, it’s time to start transitioning at that point. During a bear market rally, we re-hedge.

The key here is the percentage loss. we’re not going to sell our puts in a mere 10% correction. we need to see very heavy selling with the QQQ down 25-30-35% before we transition. That’s the key. And really it will be percentage loss + key indicators like oversold $NYMO, overbought $VIX and deeply oversold daily RSI. We FOUR different 10%+ rallies in the 2022 bear market with one going for 17% and another for 26%. Those are HUGE rallies.

When things slow down, I am very interested in this new chapter segment especially because it;s clear when at or near the bottom. Not so clear when to put on a hedge. I was looking at April 15, 2025 daily briefing when you put on hedges with QQQ @ ~$465, aside from a big move up from $402, it wasn’t actually overbought IIRC, but proceeded down again not long after. This makes putting on hedges very very hard. You even mentioned on that day, you might be early but were getting antsy.

So the hedge that we put on at 465 was absolutely necessary and even knowing what we know now we would definitely have to do it

The 465 level, particularly the 467 level, was a very big level of resistance because of the gap. That was the gap created by the liberation day nonsense.

So it was a level where, if the QQQ was in a bar market, that was a place where it was logically top

Now, when we buy that hedge, we are buying it specifically to allow us to continue holding the position up to where it is now.

While it did eat into our profits by a very tiny amount, it is precisely what made us comfortable, holding the position all of this time.

No hedge, and we would sit there and wonder whether the market was peeking every day

We didn’t have to do that because we were hedge.

The cost that we paid again, very small relative to gains, allowed us to continue to participate to the upside with total peace of mind.

Now that we’ve climbed to 520 we have to consider hedging again to protect our profits that we just made.

Here’s how we do this. Once the QQQ test it’s all-time highs, which is now pretty inevitable, we will sell premium against our position and use that premium to purchase puts

That way, if the QQQ tops and has a major correction, we are protected.

If the QQQ continues to rise to 600 to share, our premium probably caps us at $600 anyway.

For example, when we get to 540 we will look to sell the 580 calls hopefully for around $15-$20

Meaning, we get to participate up to $600.

This is gonna play out differently in every correction and under different circumstances

But the general idea is the same.

For example, in August, we bought the QQQ and Nvidia during the August capitulation day. August capitulation played out very similarly as April 7 capitulation. We had the same rally afterward.

And like the April 7 capitulation, we waited to hedge near the previous highs at around 480 share.

We hedged again a second time at 540.

That’s how it’s always going to be. We did the same thing in Lannister and To a certain degree. We did the same thing with Stark.

The strategy is to buy at extremely, wait for a rebound and then hedge.

Where to hedge exactly is entirely market dependent. It is specific to each environment.

Often times we’re going to hedge at critical areas of resistance Places where the market might peak.

467 a share was a major area resistance for the NASDAQ 100. That was the reasoning for why we hedged when we did. And that hedge was intended to protect our position, and to ensure that if there was a crash that we would capitalize.

Notice that Arryn purchased double the hedge and was sitting at $160,000. Here we are at 5:20 and Erin has risen a 240,000. So we’ve made about $80,000 or 80% relative to our cost basis even having double the hedge.

So he didn’t really eat into our profits all that much.

I get it in real life. It hurts to see those numbers. I was just talking to my wife about that yesterday. Like I look at my account and I cringe when I look at my hedges. But it’s absolutely necessary.