I get a lot of questions—both in my email inbox and on Reddit—about Nvidia’s recent stagnant share price, with investors wanting to know where the stock is headed. So I thought it would be useful to briefly explain where things stand with Nvidia and where it is likely headed over the near-, intermediate-, and long-term time frames.

To start, it’s important to understand that while all stocks tend to follow certain broad technical rules, each one also develops its own unique trading behavior. For example, Tesla has a long-established pattern of swinging to extremes in both price and sentiment. The stock regularly rallies to euphoric highs when investor enthusiasm becomes overheated, only to experience sharp declines soon after as sentiment flips to the opposite extreme.

Just this past April, Tesla collapsed from highs near $470 a share down to roughly $220, where it spent nearly two full months testing and retesting the low-$200 range. You can clearly see this boom-and-bust behavior on any long-term chart. Tesla experiences more 100% rallies and 30–50% drawdowns than almost any other large-cap stock I follow. In just the last 12 months alone, it moved from $200 in November to $490 in December, then back down to $220 in March, and now up to roughly $480 again. That’s simply how Tesla trades. And yet, despite its volatility, Tesla still respects overbought and oversold indicators, retracement levels, major support lines, and the general technical rules of trading. It has a unique personality, but it still operates within a broader technical framework.

Apple provides another example. For many years, Apple followed a remarkably consistent seasonal pattern—rallying from July into January, peaking in January, then declining and bottoming in July before repeating the cycle. This behavior persisted from the introduction of the iPod through the early and middle stages of the iPhone era. While that exact pattern has evolved over time, Apple has maintained some version of this seasonal rhythm for decades.

Some stocks barely dip into oversold territory before rebounding, while others require deep oversold conditions before a meaningful rally can begin. The key takeaway is this: every stock has its own trading signature, but nearly all of them still follow broad, widely applicable technical rules.

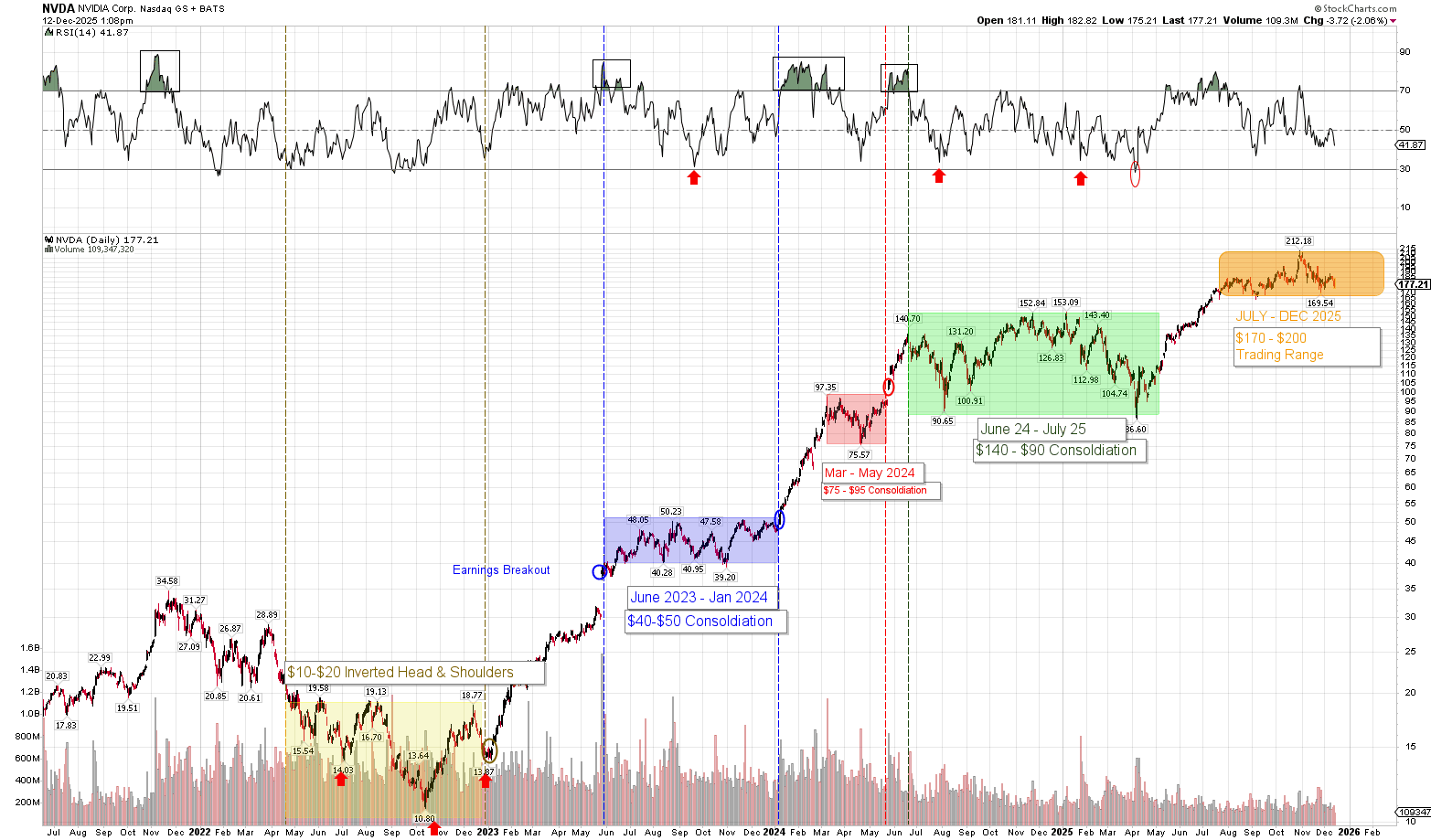

Nvidia is no exception. Over time, it has developed a very consistent trading pattern. The stock tends to make most of its gains in short, powerful bursts to the upside, followed by long, multi-month consolidation periods. This rally-then-digest cycle has repeated consistently since the lows of the last bear market.

Typically, Nvidia rallies for one to three months and then spends the rest of the year consolidating those gains—a pattern that is clearly visible on the chart below.

In fact, as seen in the chart above, since its October 2022 lows of the last bear market, Nvidia has undergone FIVE (5) distinct Rally-Consolidation Cycles that have produced Nvidia 2000% returns from its $108 a share at the lows up to $2122 a share (split adjusted) at the highs set in November 2025.

The first breakout carried the stock roughly 500%, from its bear-market low near $108 to its first major consolidation phase. That consolidation lasted about six months, during which Nvidia traded in a tight range between $400 and $500 pre-split ($40–$50 post-split). This phase is highlighted in blue on the chart above.

When that consolidation ended in early 2024, Nvidia broke out again and rallied almost straight up to $970 ($97.35 post-split). From there, the stock entered another consolidation, spending roughly three to four months trading between $75 and $97 before breaking out again following earnings and the stock-split announcement. That breakout pushed Nvidia to $1,400, after which the stock sold off sharply, falling to around $90 in August 2024.

That decline marked the start of a larger six- to eight-month consolidation period, which produced highly profitable trading conditions. During this phase, Nvidia repeatedly traded between roughly $100 and $153. Once that consolidation resolved, the stock bottomed near $86 and then rallied to a high of approximately $212, bringing us to the present situation.

This leads to the key question: what does the current consolidation look like, how long is it likely to last, and where is the lower end of the range? Those answers become clearer when we examine the second major trend Nvidia has exhibited over the past several years.

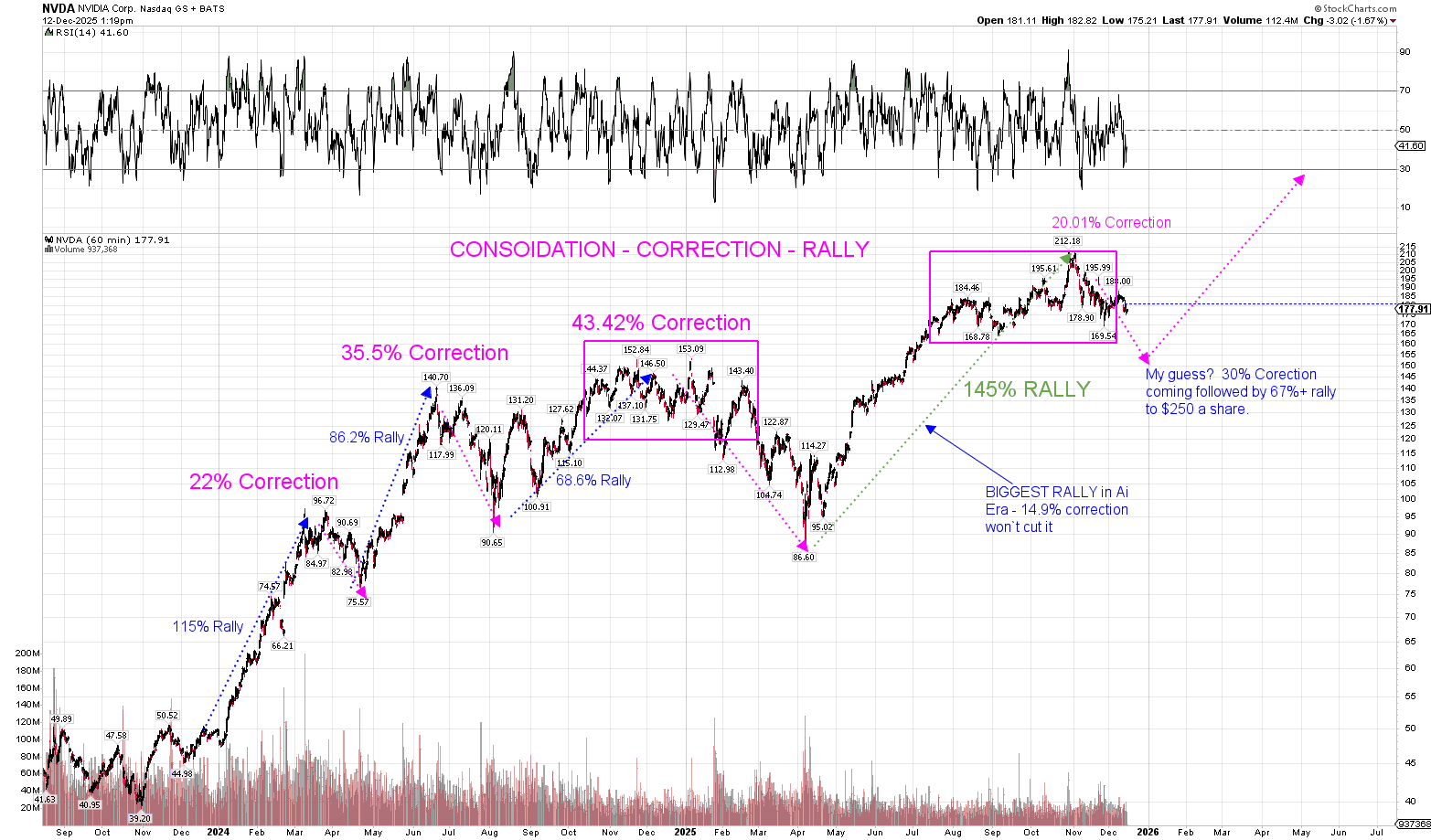

Alongside its breakout–consolidation behavior, Nvidia has consistently followed a rally–correction cycle. Since the start of the 2023–2026 bull market—during which Nvidia emerged as the market’s clear leader—the stock has always retraced a meaningful portion of its gains. In practice, a 100% Nvidia rally has been followed by a 20–40% correction. This is not unique to Nvidia; it’s a fundamental characteristic of how markets function. Parabolic advances inevitably lead to profit-taking, and profit-taking necessarily produces corrections.

Historically, the smallest correction Nvidia has experienced after a major rally is roughly 22%, measured peak to trough. Larger advances have consistently produced deeper pullbacks, often closer to 30%. Below, we’ll walk through those correction phases in detail.

As you can see in the chart above, the last few years were marked by the follow rally -correction cycles:

The Nvidia (NVDA) Rally-Correction Cycle

FRIST CYCLE

Rally 1: $44.98 to $96.72 (+115% returns)

Correction 1: $96.72 to $75.57 (-22% loss)

SECOND CYCLE

Rally 2: $75.57 to $140.70 (+86.2% returns)

Correction 2: $140.70 to $90.65 (-35.5% loss)

THIRD CYCLE

Rally 3: $90.65 to $153.09 (+68.6% returns)

Correction 3: $153.09 to $86.60 (43.42% correction )

FOURTH CYCLE

Rally 4: $86.60 to $212.18 (+145% returns)

Correction 4: Currently 20.01%

Notice that Nvidia’s most recent 145% rally has so far produced what is, by far, the smallest correction of this entire cycle—just over 20% which is simply not enough. It is highly unlikely that $169.54 represents the final low before the next breakout phase. Over the coming months, Nvidia is far more likely to test the $150 level as part of a normal and healthy corrective process before it makes any substantial new highs from here. It is far more likely to see $150 than it is to see $250 in the coming months. Down the line, however, Nvidia is on a slow march to $300 long-term.

But when we’re talking about the near and intermediate-term time frames, Nvidia is due to sustain a much larger correction after having produced the largest rally of the entire AI era. It is due for a 30% correction. That’s the simple truth.

There is a possibility that the entire NASDAQ-100 (QQQ) could rally to $700 a share before sustaining a major correction. We’ll know within the next 10-trading days whether the market is going down that path based on whether new highs are made. If not made within 10-days, then we’re likely to see a big sell-off in January 2026 and that is likely to put downside pressure on on Nvidia toward $150 a share.

What’s more, even if the NASDAQ-100 (QQQ) does make a push in early 2026 toward $700 a share,, Nvidia probably only ends up with incremental new highs and will sustain a larger correction anyway in the months of February and March. At some point in the next few months — whether after another sharp rally on the QQQ or right at the start of the new year — both the entire NASDAQ-100 and Nvidia are due for a large correction.

Notice the QQQ has just completed what was its third-largest rally of the past 27 years, trailing only the dot-com rally and the post-COVID rally. This post-tariff rally now ranks third overall, and history suggests that periods like this are typically followed by massive profit-taking across the broader market. There’s typically a big correction that follows.

But then after that happens, Nvidia likely begins its next rally up to $250 a share. My guess is Nvidia tests $150 at he lows (top of the previous consolidation range) by February and those lucky enough to buy at those levels will see about a 67% return up to $250 a share by next Fall. That’s probably how the first 9 or so months of 2026 play out. Big correction down to $150. Big rally up to $250.

Nvidia’s next long-term target is clearly $300. It is the price that most investors are eyeing and Nvidia will inevitably reach those levels. But that is going to take some time to develop. What’s more, it is important to point out that 1-year after the Covid rally ended, the entire economy entered a bear market and the QQQ fell 39%. After the dot-come rally ended, the QQQ fell 40% in 40-days and down 90% 1-year later.

The point here is this. The QQQ has just come off the third largest rally in at least 27-years and for the other top 2 rallies, the market saw massive BEAR MARKET within 10-months of those gains. The key is to always hedge and that’s what we do at Sam Weiss. We hedge our long positions so that we don’t have to worry about it. We produce our gains on the upside by being roughly 80-87.5% long and hedge out the risk of any bear market by purchasing put-protection against our positions. We’ll do well in a bear market and we’ll do even better in a bull market.

Anyway, the bottom-line here is this. We expect Nvidia to fall to as low as $150 in the coming months, bottom and then begin a new rally in 2026 that takes the stock up to as high as $250 a share. It’s clear investors have $300 on the mind, but the next target for Nvidia is $250. That’s where the stock is likely to run up against resistance.

Sam, what about the Baratheon and Targaryen portafolios. Any plan ?

At extremes, we’ll put on trades. We need extremes where the trade is very high probability.

Love this post. At the end of the day, this is one of those stocks that you buy and hold for the better part of the next decade (and maybe then some)? Maybe we’ll start making some plays for TSLA and GOOGL as well!

We need opportunities for both. Meaning, when both sustain major corrections, we’ll take a look. We already have indirect allocations in both via the QQQ.