With the most recent corrective period now extending to a total of 56 trading days since the NASDAQ-100 (QQQ) reached its all-time highs of $503.50 a share back in July, the big question before us is whether that corrective period has already ended or whether we’ll see another leg down in the fourth quarter which begins on Tuesday.

It has been our contention that the entire stock market fully bottomed on August 5, 2024 when the QQQ reached $423.50 a share. Our three biggest pieces evidence in support of that forecast are (1) the massive rebound off the lows which retraced a full 80% of the losses for the NASDAQ-100; and (2) the fact that the NASDAQ-100 sustained a second full-blown correction of 8% in a failed attempt to retest the lows; and (3) the fact that both monetary policy and the economic environment fully support a continuation of the bull market that began in January 2023.

We’ve already extensively covered the reasoning behind this contention over the last three weekly roundups. The analysis we published last Sunday in the post entitled, “New Rally Cycle on the Horizon,” is still valid/current information and covers the reasoning in greater detail.

In fact, last week’s trading action changed nothing with respect to our outlook published in that article.

This week’s post can be viewed as a mere extension of last Sunday’s weekly round-up, and to avoid being repetitive, we won’t be discussing that analysis much here except by reference.

However, I do want to stress two crucial points that do bear repeating. First, a big reason we extensively cover the NASDAQ-100 — beyond being a great long-term intrinsically diversified asset — is that stocks don’t trade in a vacuum. What impacts the NASDAQ-100, impacts all of its component stocks. If the NASDAQ-100 goes down, so does Nvidia, Google, Apple, Amazon, Tesla and every other stock that is a member of the index. It is crucial that all investors understand this fact. As goes the NASDAQ, so goes Nvidia. The NASDAQ-100 peaked at $503.50 in mid-July before dropping 16% down to a low of $423.50 on August 5. Nvidia peaked at $140 in mid-July before falling 35.72% to a low of $90 a share on August 5. The NASDAQ-100 then rallied 15% up to a high of $486.50 from August 5 to August 18. Nvidia rallied 45% from a low of $90 on August 5 to a peak of $130 on August 18. This is a crucial lesson that all investor need to learn and fully understand. Stocks do not trade in a vacuum. The S&P 500 falls 57.5% in the financial crisis, Apple, Amazon, Microsoft, Google and all other stocks also fall 55-60% in the financial crisis. It doesn’t matter how strong the company’s fundamentals are. If the market falls, all stocks go with it.

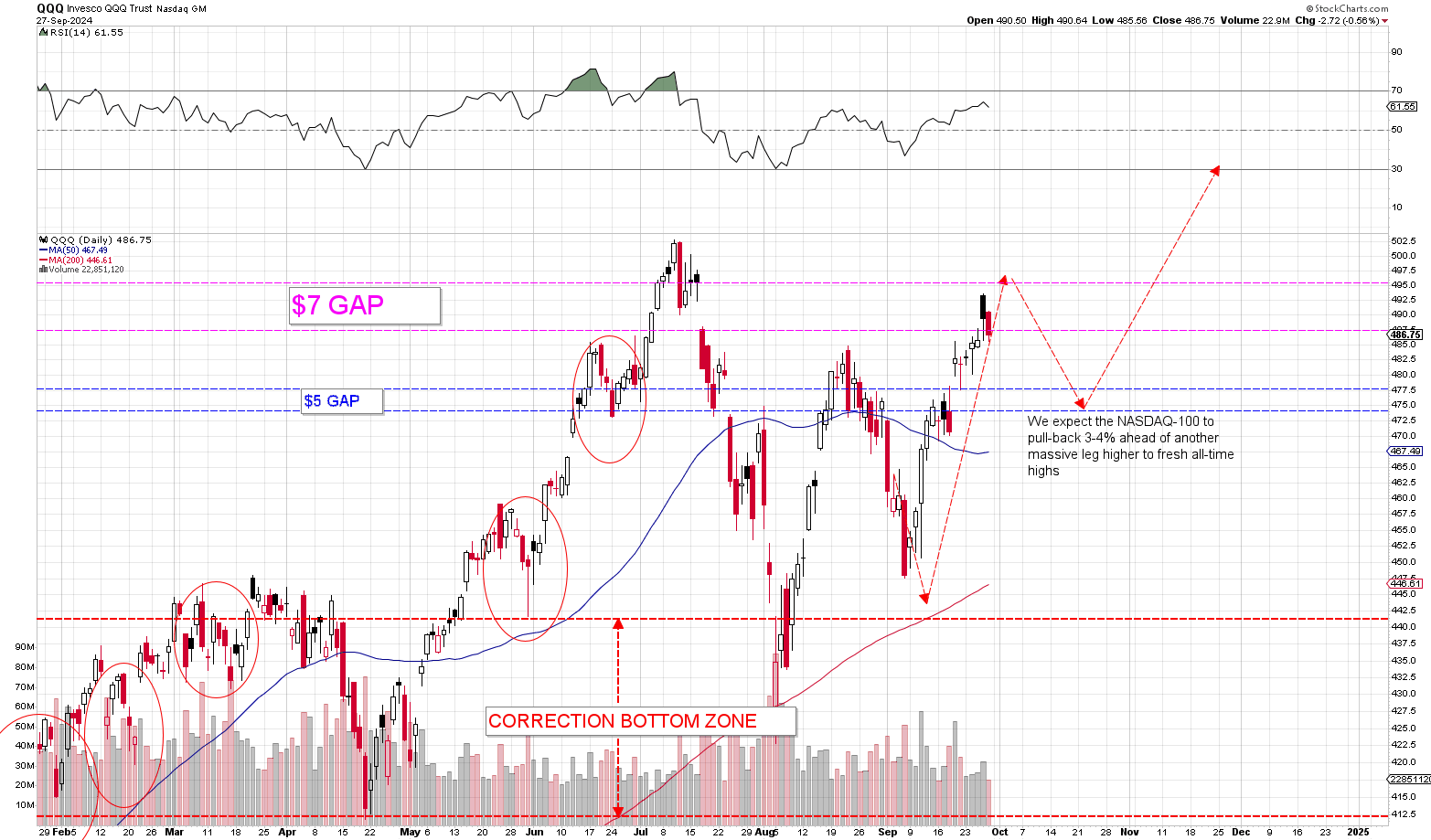

Second, we have different outlooks for different time periods and it’s very easy to conflate those outlooks. For example, right now, we believe the markets are very close to a near-term peak ahead of what will likely be a bout of very heavy near-term selling pressure. We expect the NASDAQ-100 to drop 3-4% during that near-term pull-back. But as the intermediate and long-term outlook is concerned, we believe the market is moving higher. Long-term, we believe the NASDAQ-100 moves substantially higher and expect we’ll see $600 sometime in the next 12-months or sooner. That’s a 23% move up over the long haul.

To that end, we’ll first discuss our near-term outlook, move toward our intermediate-term forecast and then discuss some of the risks we’re concerned about as we head into the fourth quarter of 2024.

Near-term Outlook: NASDAQ-100 due for a 3-4% pull-back from its highs

As we discussed last Sunday, the NASDAQ-100 is drawing very close to a near-term peak and will likely experience a 3-4% pullback before moving higher in the intermediate-term. We have THREE major reasons in support of that forecast.

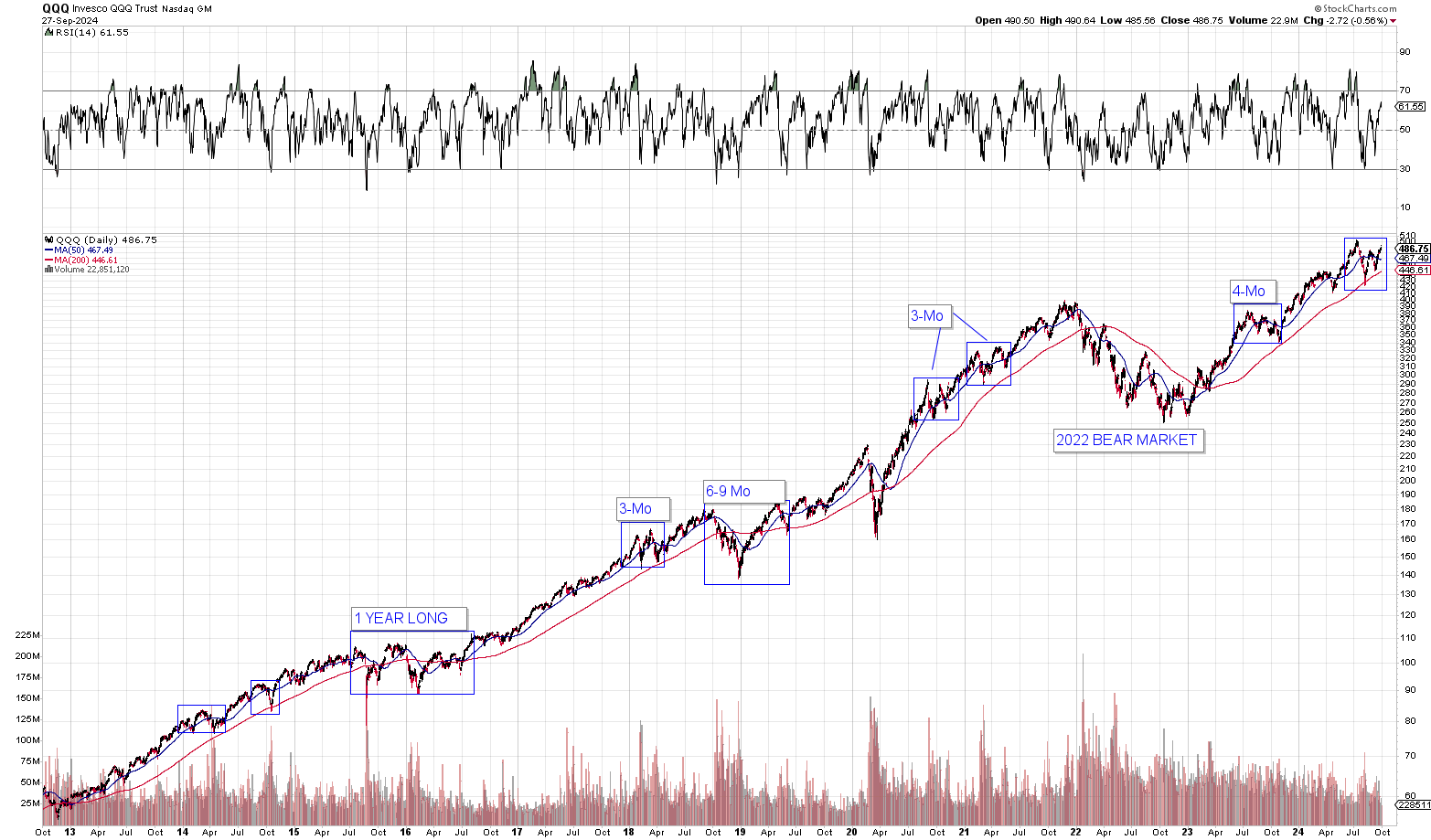

First, as we mentioned last Sunday, the bull market has unfolded in a very specific way since bottoming in December 2022. In fact, we’ve seen this repetitive pattern go back all the way to 2018. The same exact cycle has been going on for 6 years now without fail. What we’ve seen is that the NASDAQ-100 (QQQ) tends to move up in segments. It doesn’t rally straight to the mom nonstop. That’s not how it works.

Instead, what we’ve seen over the last 6 years, and particularly since the 2022 lows, is that the NASDAQ-100 will rally between 8-10% on average over a period of 12-24 days, peak and then pull-back 2-4% over a period of 3-7 days. After bottoming it then begins another 8-10% rally over 12-24 sessions, peaks and drops 2-4% for 3-7 days. That’s the typical cycle and this will go out until the NASDAQ-100 ultimately puts in a major top ahead of an 8-12% correction. Since bottoming in December 2022, the bull periods have lasted roughly 100 trading sessions on average with 3-4 of these rallies, peaks and pull-backs occurring over the period. This table below, which we posted last Sunday, shows all of the recent segments going back to beginning of this bull markets in Dec 2022:

As you can see from the table above, this recent segment, which started 3-weeks ago, is now pushing into the high end of the range in terms of both percentage gains and duration. In fact, this segment which began on September 6 when the NASDAQ-100 bottomed at $447.50, is now the fifth largest rally and the sixth longest out of the twenty segments going back to January 2023.

Now obviously there’s no way to know for sure just how long this rally will continue. But we do know that the historical trend indicates that we’re at the high end of the range and that the NASDAQ-100 is likely to experience a 3-4% pull-back. The total sell-off column illustrates this pretty clearly. As we mentioned last week, a 3-4% pull-back on the NASDAQ-100 assuming a peak of $493.70 would take the QQQ down to a low of around $470 to $478 a share.

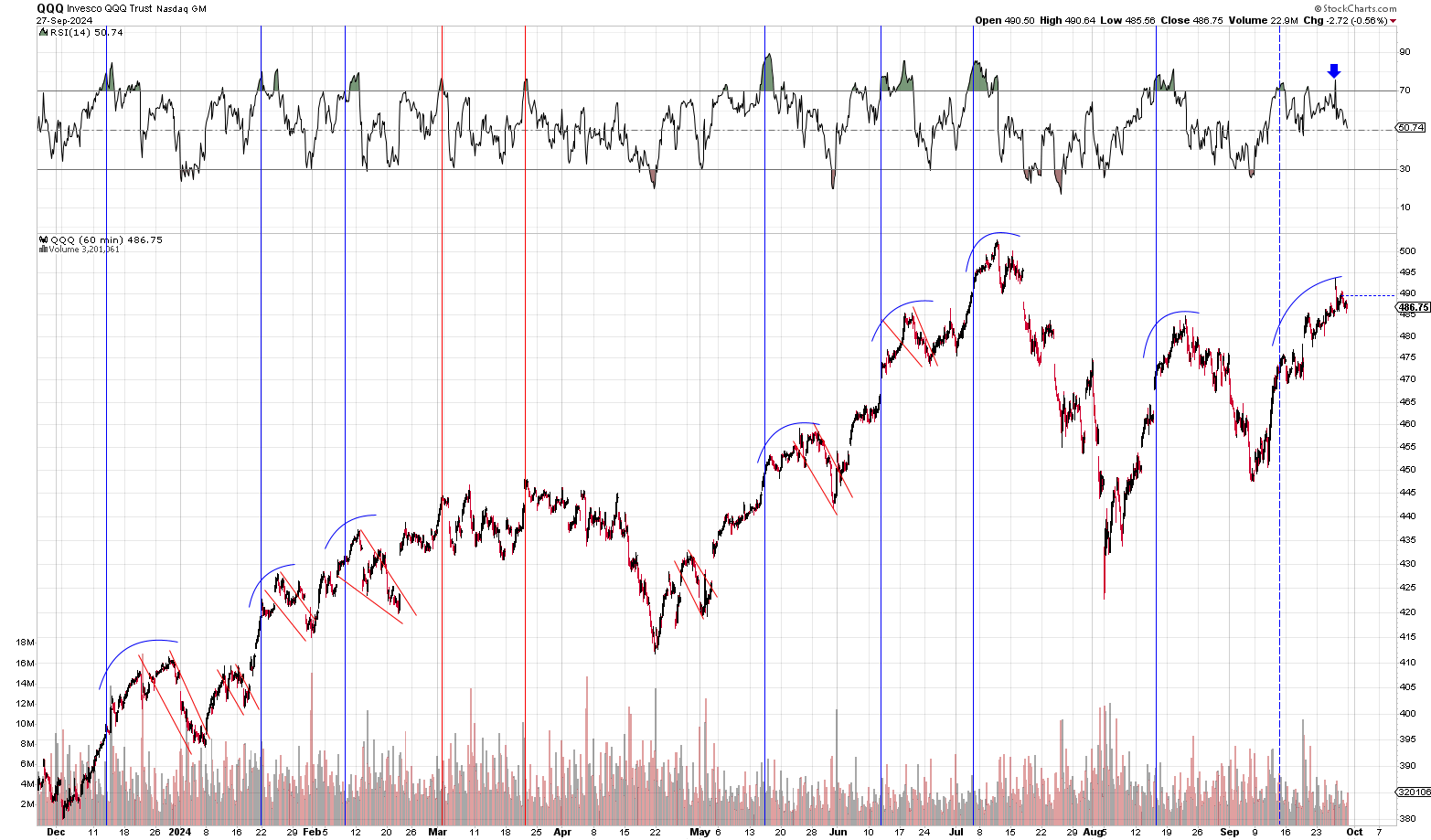

Beyond the historical trend, the second big reason we expect the NASDAQ-100 to pull-back soon is the fact that it has entered into the overbought cycle. What we’ve seen historically is that anytime the NASDAQ-100 (QQQ) first enters overbought territory, a sort of countdown begins. We enter into a sort of lag period where the NASDAQ-100 continues to drift higher but on lower momentum. An overbought RSI on the hourly time-frame is generally the first signal we get that the NASDAQ-100 is nearing a peak and/or that the NASDAQ-100 is in its last stages of the rally. It does’t signal a peak in and of itself. In fact, the NASDAQ-100 reaching an overbought RSI almost always means more IMMEDIATE upside ahead. But what it does often signal is that we’re in the final stages of the rally. You can see that on the chart below which is self explanatory:

As you can see from the chart above, once the NASDAQ-100 enters overbought territory, there’s a lag period that follows where we see more immediate upside on the back of the strong momentum in the index. But then after that, we generally tend to see a peak ahead of a 3-4% pull-back. In fact, every red and blue line you see above and arc on the chart represents a period where the NASDAQ-100 fell at least 3% during this past year. Interestingly enough, the current lag period which began in mid-September is the longest we’ve seen in the last year. The QQQ has gone up considerably since first reaching overbought territory near $475 a share. In fact, the QQQ has run another $18 since reaching $475 in mid-September.

This fact could be interpreted in two different ways. It could indicate that we’re really at the tail end of this segment now or it could mean that the QQQ is bucking the trend. We won’t know until we see the trading action this week which I think will be very determinative.

The third big reason we believe the NASDAQ-100 and the broader market are due for a sharp pull-back to start the quarter is that the recent trading action has been a bit bearish. We talked a bit about this during the week. But here’s what you generally want to see happen during a rally. At least this is how the NASDAQ-100 has historically traded during aggressive moves to the upside. What we generally want to see is the NASDAQ-100/SPY/Dow open the day flat to slightly higher with buy programs taking the indices up all day long to close near the highs of the day. The average daily gain generally falls within the 0.4% to 0.5% range in these rallies. So 20 trading days to reach 10% of upside is a good strong move indicative of a healthy bull market.

These types of days are generally marked by big white candlesticks on a chart. Generally speaking, what you want to see is back-to-back-to-back white candlesticks on the chart. The strongest rallies on the NASDAQ-100 tend to unfold in this manner and that is largely what we’ve seen over the last 24 months.

What usually tends to end these near-term 8-10% segmented rallies on average is the emergence of doji and several candlesticks. Days where the market has enetered a period of indecision and/or days where big up moves are met with heavy selling. Without delving too deeply into the technicals, it’s important to point out that the last seven trading days have had either a reversal bar (filled red bar or black bar), a doji or a session where all of the markets gains were had from a gap-up (the Thursday after the fed cut rates). The entire first half of this September 6 rally saw nothing but back to back white candlesticks util the QQQ reached $475 a share. But since then, we’ve seen nothing but negative type days. The last two days the market reversed its gains on the sessions. We had big gap-ups met by all-day sell programs.

Anyway, the take away here is we have three separate and strong reasons for believing the NASDAQ-100 will soon peak and fall 3-4%. Our plan is to buy on the next 3-4% pull-back from the peak as we do believe the intermediate-term will take the markets higher after the pull-back ends.

Nvidia & Google are on watch for near-term buying Opportunities

While we’ve already concluded nearly almost all of our buying on in Nvidia, we do still need to add a roughly 7% position in our Samwise Leaps portfolio. Common stock wise, we’re already fully invested in our 25% allocation into Nvidia (NVDA) at average cost of $103.70. So we won’t be adding to our common stock position. But in the leaps portfolio, we will be looking to buy Nvidia on this upcoming near-term pull-back in the NASDAQ-100. We also plan to buy Google (GOOGL) as we believe there’s a strong long-term opportunity there. We will also add to our NASDAQ-100 long position.

With the NASDAQ-100 due to pull-back 3-4% near-term, we do believe Nvidia will likely drop to around $110-$115 a share in the coming weeks. And there’s a very good possibility that this pullback could mark the last opportunity to buy Nvidia (NVDA) in the low 100’s. As we discussed a few weeks back, Nvidia has entered into a long consolidation period much like the one we saw last year. But that consolidation isn’t going to last forever. Nvidia has already traded sideways for an entire quarter at this point. By the time it reports fiscal Q3 in November, it is likely that Nvidia moves up to a new trading range. The stock has traded in this exact manner for years now. It goes on big runs, reaches a critical peak and then it will consolidate over a period of 3-5 months with much of the opportunity being derived from the extreme volatility.

The next likely trading range for Nvidia is going to move up to $130-$160 a share with $160 being the higher end of the trading range and $130 being the lower end of the range. With $130 having represented the zone of heavy resistance for Nvidia over the last 3-months, that same $130 level will very likely act like support. Just like $970 (pre-split) acted like resistance/support in the last zone between $750 and $970 a share in the spring.

Nvidia is most likely to make a move into that new trading range as we head into Nvidia’s fiscal Q3 earnings report in November. With the NASDAQ-100 likely to begin a new rally after the next pull-back, the big takeaway here is that these first few weeks of October are likely to represent the last strong buying opportunity for Nvidia in the low $100’s.

As Alphabet (GOOGL) is concerned, we expect to see the stock pull-back to the mid-$150’s which will mark a strong buying opportunity ahead of a rally up to $200 a share in 2025. That’s a full 30% in upside for the stock. Chances are we should see that pullback materializes during this near-term sell-off in the NASDAQ-100.

Opportunities in the $5k to $1 million Challenge

With the NASDAQ-100 slated to pull-back early next week, there should also be an opportunities to make some trades in our $5k to $1 million challenge. While we normally prefer to make those trades on full blown corrections, if Nvidia drops to $110 on this pull-back, that will create an opportunity to make our first trade in the $5k to $1M challenge portfolio. You can read more about the $5k to $1 million challenge here.

Intermediate-Term Outlook: NASDAQ-100 (QQQ) to blast through aTH and reach $520 a share in November

As we explained earlier in the post, we’re not going to rehash all of the reasons we believe the market has already bottomed and entered into the next leg up in the bull market. What we will say is that during all bull markets, the indices will inevitably enter into a corrective period that lasts an extended period of time. The 12-year chart below outlines all of the times the NASDAQ-100 entered into one of these corrective periods. The last one we saw happened between July and November of last year and lasted four months or 71-trading days total. This recent one that began in mid-July has already gone on for two and a half months. The most important thing to realize is that once these periods end, the bull market continues. In fact, after these consolidation periods end, we tend to see an explosive rally to the upside. See below:

One thing that is worth repeating is the fact that presidential elections have largely been a huge positive influence on the market. We tend to see the markets move higher the weeks and months following an election. The only recent exception being the November 2008 election which occurred just after the peak of the financial crisis. But even then, it wasn’t more than 2-months into President Obama’s first term that we began to see the markets rally big time with the announcement of QE1 in march 2009.

The chart below outlines our outlook for both the near and intermediate-term. Again, this all impacts every individual stock trading on the NYSE and NASDAQ. As the market goes, so goes all individual names:

SHORT & INTERMEDIATE OUTLOOK SUMMARY: We expect the NASDAQ-100 to pull-back 3-4% down to a low between $470 and $478 before rallying to fresh all-time highs up to $520 per share. The NASDAQ-100 should peak sometime in the next week and the pull-back should last no more than 3-5 trading days.

The Risks to the Intermediate-term Outlook

Anytime the market enters into a long consolidation period as recently it has, there’s always the risk that we could see another big leg lower like we saw when the NASDAQ-100 peaked at $486.50 back in late August. That risk is always there. We could easily see the market peak at $495, begin to sell-off 3-4% as we expect and then instead of bottoming out at -4%, the selling accelerates. Before we know it, we’re on another leg lower. This is how a 3-month consolidation can quickly turn into a 4-month or 5-month consolidation.

Now I do think it is important to point out that given the size and explosiveness of the rebounds off of the $423.50 lows on August 5 and the $447.50 lows of September 6, the market is a lot less likely to see a third leg lower. And even if one were to materialize, not much is likely to come from it beyond another good buying opportunity.

Again, that is due to the response we’ve thus far seen on the last two corrections. The rebounds have been explosive and the buying heavy. With near full retracements happening after each leg lower, the bears don’t have a lot of ammunition to really push the markets into any sort of extended sell-off.

That being said, even if the market were to see an extended sell-off, we’re well positioned to weather anything the market throws at us. Having bought near the lows of the correction and having a longer term time horizon means we can weather a full blown bear market if it were to occur.

Hedging Plan for the Samwise Portfolios

As we mentioned above, once the NASDAQ-100 begins its 3-4% pull-back in the coming weeks, our plan is to get 100% long in both of our Samwise Portfolios. Once we do so, our plan is to buy a long-term put-spread to hedge over the long-term. You can read about our hedging strategies in Chapter 3 of our core investment principles. Chapters 1-3 in investing basics forms a large part of our overall strategy.

Do you think that we are already in the pullback with the QQQ peaking at 493? If we continue to see it move lower on Monday, should that be a pretty good indicator? Or do you think it’s more likely that we will see it bounce up to 495 before the 3-4% pullback?

I too have this same question

So I mentioned this in last Friday’s daily post I believe. Someone asked the same question. It is very possible that it has already started. In most cases, we won’t know until the pull-back fully unfolds.

As you can see from the tables, once the QQQ drops 3% from whatever peak it reaches, that’s the pull-back. So if the QQQ were to continue lower down to $378, that’d be it right.

In terms of whether this is or isn’t is a dice roll. The QQQ could easily see another push to the upside and make new highs before peaking. That could easily happen. The closer we get to 20 sessions, the more likely it is that we’ve already peaked. As of today, we’re at 16-sessions.

Makes sense, thank you!